Stanley Druckenmiller’s Strategic Acquisition of Daktronics Inc Shares

Overview of the Recent Transaction

On May 2, 2024, the investment firm led by Stanley Druckenmiller (Trades, Portfolio), Duquesne Capital, made a significant move in the stock market by purchasing 2,493,605 shares of Daktronics Inc (NASDAQ:DAKT). This transaction marked a new holding for the firm, with the shares acquired at a price of $10.12 each. This acquisition not only reflects a substantial investment but also indicates a strategic positioning within the firm’s portfolio, representing a 0.75% position.

Profile of Stanley Druckenmiller (Trades, Portfolio)

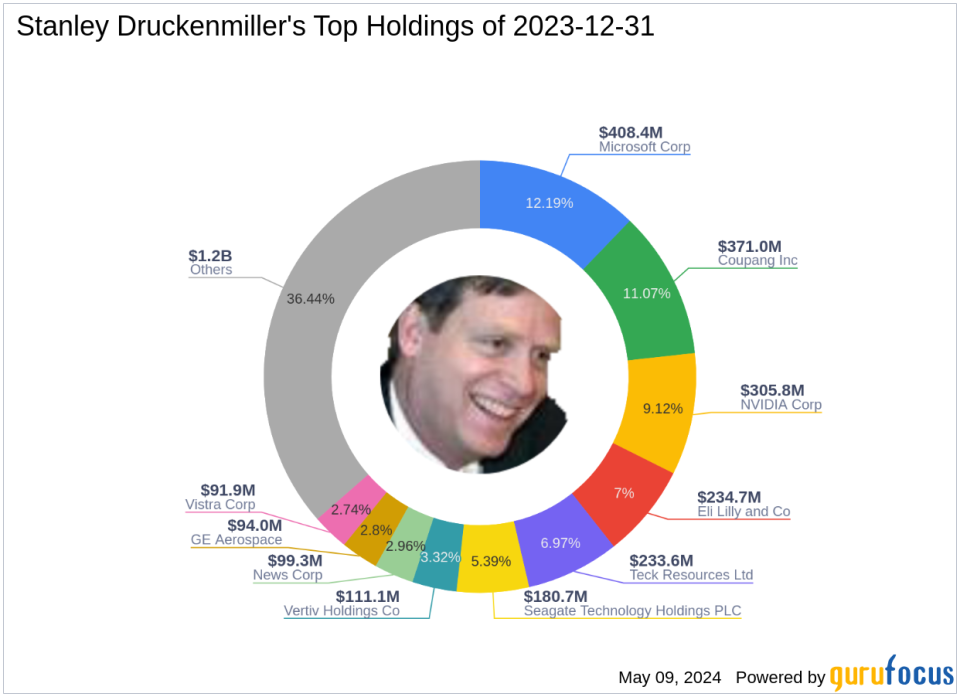

Stanley Druckenmiller (Trades, Portfolio), the President, CEO, and Chairman of Duquesne Capital, is renowned for his dynamic investment strategies, often reflecting the influence of George Soros (Trades, Portfolio). Since founding Duquesne Capital in 1981, Druckenmiller has demonstrated a keen ability for a top-down investment approach, skillfully navigating long and short positions across diverse asset classes. The firm currently manages an equity portfolio worth approximately $3.35 billion, with a strong inclination towards technology and consumer cyclical sectors.

Introduction to Daktronics Inc

Daktronics Inc, established in 1994, has grown to become a leader in the design and manufacturing of electronic scoreboards, programmable display systems, and large screen video displays. The company primarily serves sectors including Commercial, Live Events, and Transportation. With a market capitalization of $492.412 million and a diverse product range, Daktronics is a significant player in the electronic display market.

Financial and Market Analysis of Daktronics Inc

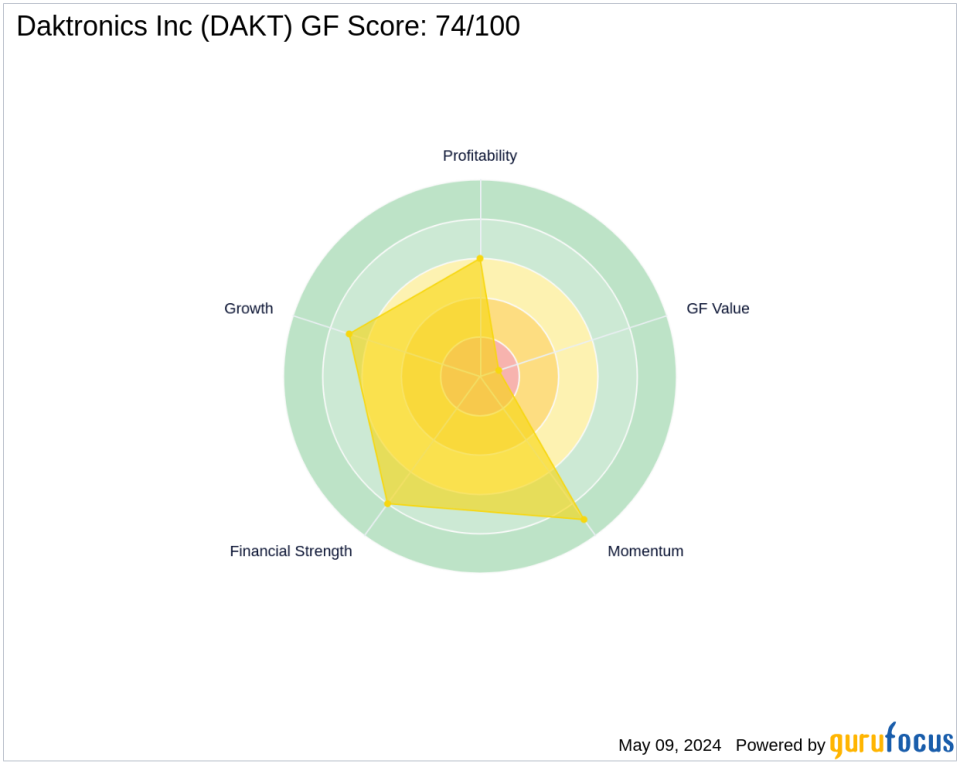

Despite being labeled as significantly overvalued with a GF Value of $6.58, Daktronics has shown robust market performance with a stock price increase of 9.88% since the transaction, currently priced at $11.12. The company holds a GF Score of 74/100, indicating a strong potential for future performance.

Furthermore, Daktronics boasts a solid financial structure, evidenced by its high interest coverage ratio of 27.28 and a respectable Profitability Rank of 6/10.

Impact of the Trade on Druckenmillers Portfolio

The recent acquisition of Daktronics shares significantly diversifies and strengthens Druckenmiller’s portfolio. Holding 5.40% of Daktronics’ shares, the firm has positioned itself as a key stakeholder, potentially influencing the company’s strategic decisions. This move aligns with Druckenmiller’s history of making concentrated bets in sectors poised for growth or significant transformation.

Market Reaction and Future Outlook

Following the transaction, Daktronics’ stock has shown a positive trajectory, reflecting investor confidence possibly spurred by Druckenmiller’s involvement. The future outlook for Daktronics remains promising, considering its solid market position and ongoing innovations in display technology. Continued growth in the Live Events and Commercial segments could further enhance its market valuation and profitability.

Conclusion

Stanley Druckenmiller (Trades, Portfolio)’s recent investment in Daktronics Inc represents a strategic addition to Duquesne Capital’s diverse portfolio. With a strong financial foundation and a positive market response, Daktronics is well-positioned to capitalize on future growth opportunities. This transaction not only underscores Druckenmiller’s confidence in Daktronics but also highlights the potential for significant returns on this investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.