Steel yourself — the stock market is irrationally exuberant again

The markets set new record highs as if there were no tomorrow.

Golden House Images – stock.adobe.com

Reflecting on the stock market, Sir Isaac Newton famously remarked he could calculate the movement of the heavenly bodies, but he could not calculate “the madness of man.”

We have to wonder what he’d be saying about today’s US stock market.

While major economic and geopolitical risks to the economic recovery are in plain sight, the markets set new record highs as if there were no tomorrow.

The Dow closed Monday above 38,000 for the first time, and the S&P 500 had a record finish too.

How quickly markets have forgotten how off guard they were caught in 2008 with the US subprime and housing market bubbles bursting.

Those events led to the sharpest market decline since the 1929 stock-market crash.

The major economic risk now confronting us is the result of the Federal Reserve’s hawkish monetary-policy stance and the COVID-19 pandemic’s fallout on work and shopping habits.

From June 2022, the Fed has engaged in the most aggressive interest-rate-hiking cycle in the postwar period.

In the short space of 15 months, it raised interest rates by 5¼ percentage points.

At the same time, it reduced the size of its balance sheet by more than $1 trillion through quantitative tightening.

That sent interest rates sharply higher and caused major damage to the banks’ balance sheets by reducing the value of their bond portfolio.

Thanks to the Fed’s actions, the banks have bond mark-to-market losses estimated in excess of $600 billion.

We’re also seeing rising default rates on auto loans, home mortgages and credit-card debt due to higher interest rates.

The COVID pandemic has markedly upended the $20 trillion commercial real-estate market.

Employers have found they don’t need to have their workers come to the office every day.

As a result, office-vacancy rates have jumped to a record high of almost 20%.

In New York alone, vacant office space is estimated to be the equivalent of 30 Empire State buildings.

And retail space is under considerable pressure as the trend to online shopping accelerated during the pandemic.

At last year’s start, we had a regional-bank crisis centered on Silicon Valley Bank and First Republic Bank that required Fed intervention.

High interest rates and plunging commercial real-estate prices now pose a very real risk of triggering a more vicious round of the regional-bank crisis.

It’s especially a danger since commercial-property lending accounts for almost 20% of the regional banks’ loan book and it’s difficult to see how property developers are going to be able to roll over the estimated $500 billion in loan maturities that fall due this year.

In a disturbing sign of possible things to come, major property developers like Brookfield and Blackstone are handing back the keys to the lenders.

A recent National Bureau of Economic Research paper estimates that high interest rates and a prospective wave of commercial-property loan defaults could result in the failure of almost 400 small and medium-sized banks.

If that were to occur, the all-important small and medium-sized enterprise sector that accounts for close to half the US economy would be starved of credit.

As if these economic risks were not worry enough, we have a combination of geopolitical risks of a severity not experienced in decades.

The Russia-Ukraine war constitutes the largest European land war since 1945.

The Israel-Hamas war risks spreading to the rest of the Middle East.

The Houthis are threatening to block the vital Red Sea passageway to the Suez Canal.

The Chinese are expressing their displeasure about the recent Taiwanese presidential election.

That raises the risk of souring already-strained US-Chinese relations and increasing tensions in the South China Sea.

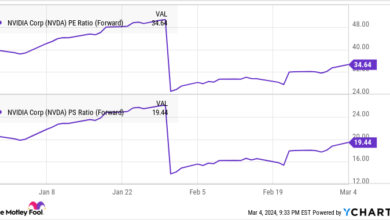

Yet despite all these major economic and geopolitical perils, the stock market remains on a tear.

It is setting all-time highs and trading at stretched valuations.

We must wonder whether this might not be a repeat of the way the stock market rallied on the eve of World War I only to find that markets had to be shut for several months to prevent a total panic when war broke out.

Or perhaps it’s a repeat of the way markets remained blissfully unaware of the consequences of the bursting of the subprime and housing market bubbles until the September 2008 Lehman Brothers bankruptcy.

In any event, it would certainly leave Isaac Newton scratching his head.

American Enterprise Institute senior fellow Desmond Lachman was a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging-market economic strategist at Salomon Smith Barney.

Load more…

{{/isDisplay}}{{#isAniviewVideo}}

{{/isAniviewVideo}}{{#isSRVideo}}

{{/isSRVideo}}