Australia set to extend rate pause as economy enters slow lane

Australia’s central bank is widely expected to hold interest rates at a 12-year high on March 19 as the economy shows signs of slowing further while unemployment trends higher.

Economists expect the Reserve Bank will keep its cash rate at 4.35 per cent for a third straight meeting, while maintaining a hawkish bias amid uncertainty over the strength of a disinflationary impulse. The board meeting – the first for Deputy Governor Andrew Hauser – begins on March 18 with the decision released at 2:30 p.m. in Sydney on March 19, followed by the governor’s press conference an hour later.

“We expect a slight tightening bias will be kept,” said Mr Chris Read, a Sydney-based economist at Morgan Stanley. “The governor will likely highlight how the data over the past six weeks has evolved broadly as expected and is consistent with continued progress towards the RBA’s targets.”

Australia’s policy announcement will likely come shortly after a decision by the Bank of Japan, which may raise rates on March 19 for the first time since 2007 following solid outcomes in wage negotiations. A day later, the Federal Reserve will probably release an on-hold decision.

RBA Governor Michele Bullock will be mindful of global inflationary trends with price pressures in the US, in particular, abating only gradually. That has led Fed Chair Jerome Powell to say he and his colleagues aren’t ready to cut rates yet.

Australian policymakers have also pushed back against bets on near-term easing, reflecting concerns that inflation remains well above the 2 per cent – 3 per cent target and is only forecast to return to the goal range at the end of 2025. Economists, who broadly see a first rate cut in the second half of the year, expect March 19’s statement to stay hawkish as inflation remains sticky.

Another reason to keep talking tough is the hot property market. Bullock and her colleagues would be loathe to further fuel home prices, which have been on an upswing driven by a supply shortage and strong population growth.

Swaps traders bet on high odds that the RBA will start easing in August, while they are fully pricing the Fed kicking off its rate-cut cycle in July.

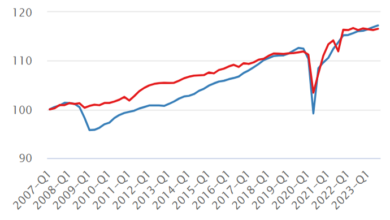

Data since the RBA’s February meeting has indicated a slowing in the economy, which grew a feeble 0.2 per cent in the final three months of 2023 from the prior quarter. In per capita terms, gross domestic product fell 0.3 per cent from the third quarter and was 1% lower than a year earlier, the deepest downturn outside the pandemic since 1991, according to Bloomberg Economics.

Monthly inflation for January came in at 3.4 per cent, below economists’ estimates, though worries remain that the impact of falling goods prices is coming to an end, while services remain sticky. Retail sales for the month missed expectations, too.

Australia’s labour market is also showing signs of loosening, although with the unemployment rate at 4.1 per cent it’s still healthy. Jobs data for February will be released on Thursday. The resilience of employment has given policymakers optimism that they can engineer a soft landing – bringing down inflation while holding onto the enormous job gains of recent years.

“There is light at the end of the tunnel,” Ms Luci Ellis, chief economist at Westpac Banking Corp., said in a research note. Ms Ellis was previously an RBA assistant governor.

“Inflation is moderating, which will help to lessen the pressure on households,” she said. “Policy is set to pivot from mid–year, with the stage-3 income tax cuts commencing from July 1 and the beginning of an RBA easing cycle, expected from September. Less restrictive policy will support an economic revival.”

On March 22, the RBA will publish its semi-annual financial stability report which will elaborate on the impact of rising borrowing costs on Australian banks, which have weathered the tightening cycle better than most expected. BLOOMBERG