Jim Chalmers warns of ‘fraught and fragile’ outlook

Dr Chalmers’ comments come ahead of March quarter inflation data on Wednesday, a key print before the Reserve Bank of Australia’s May board meeting and the federal budget.

The quarterly pace of inflation is expected to have edged higher in the first three months of the year, but the annual figure is forecast to fall from 4.1 per cent to 3.4 per cent due to base effects.

That result would be slightly below the RBA’s February forecasts, but still indicative of the central bank’s expectation inflation will not return to the middle of the 2 per cent to 3 per cent target band until 2026.

Targeted and temporary

But with the IMF forecasting economic local growth of just 1.5 per cent in calendar 2024 – the slowest rate of expansion outside the pandemic since the early 1990s recession – Dr Chalmers faces a tricky task of trying to stop the economy from stalling without stoking inflation.

Barrenjoey chief economist Jo Masters said from a budget perspective that would probably mean a continuation of last year’s mantra of targeted and temporary support, with the government offering help to low-income households that will spend on essentials and not discretionary items.

“We’ve already seen that in the redesign of the stage three tax cuts and I would not be surprised to see an extension of the electricity rebate,” Ms Masters said, adding that it was a “tricky balance”.

Barrenjoey is tipping the Australian economy was now at its weakest point and would remain subdued for the next four to five months before the July tax cuts kick in to help stave off a really sharp slowdown later this year.

“We have growth sub-1 per cent in the year to June 2024, and you don’t want the economy to sputter and stall. You want a little bit of support in there, but you do have sticky and persistent inflation.

“And while over time a slowing economy will help, it is about trying to balance how much you need to bring inflation down without tipping the economy into a scarring slowdown.”

On the spending side, the budget is expected to include more money for combatting family, domestic and sexual violence to fight what Attorney-General Mark Dreyfus labelled “a crisis of male violence”.

This new money would add to an existing $2.3 billion already announced by Labor towards implementing the National Plan to End Violence against Women and Children 2022-2032 and other women’s safety initiatives.

Opposition Leader Peter Dutton on Sunday backed a royal commission into violence against women, saying he was “happy to support anything at all that sees the incidents [of violence] reduced”.

Weakest Chinese growth since 1970s

On the global economy, China’s growth forecasts will be revised a quarter of a percentage point higher to 4.75 per cent in 2024 in the budget, but also a quarter of a percentage point lower to 4.25 per cent in 2025, with a similar result expected in 2026.

Three years of consecutive growth at below 5 per cent will be the weakest since China opened up to the world in the 1970s.

Growth in Japan is also expected to be a quarter of a percentage point lower this year at 0.75 per cent, before edging up to 1 per cent in 2025 and 2026.

In the United Kingdom, which experienced a large fall in employment last month and had inflation easing to 3.2 per cent, growth in 2025 was revised down half a percentage point to 1.5 per cent.

The outlook for the United States will be revised following the release of its March-quarter GDP figures on Thursday.

The US is faring much better than expectations, with economists forecasting annualised growth of 2.3 per cent. But the US exceptionalism is coming at a cost, with interest rates expected to remain higher for longer as a result.

Key indicator

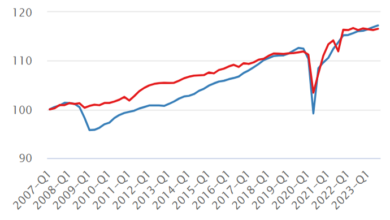

Locally, the Reserve Bank’s next move on interest rates is expected to be down, though the big question is when that will occur. Investors this month pushed back bets for when the RBA will begin cutting rates to March 2025.

The RBA’s overnight cash rate has been on hold at 4.35 per cent since November last year.

A key indicator for the next move will be March-quarter inflation data due to be released by the Bureau of Statistics on Wednesday.

Quarterly inflation was 0.6 per cent in December and economists from all four big banks expect a small uptick in March. National Australia Bank and Commonwealth Bank are tipping 0.7 per cent, while ANZ and Westpac are expecting to see 0.8 per cent,

But due to the base effects of a much larger 1.4 per cent rise in the March 2023 quarter, the annual price rise figure is expected to be smaller than the 4.1 per cent rise at the end of last year, at about 3.4 per cent.

“The key drivers are expected to be increases in rents, education, health and insurance, partly offset by softness in clothing, household goods, utilities, holiday travel and fuel,” said AMP chief economist Shane Oliver.

A result of 3.4 per cent would be just below the Reserve Bank’s implied forecast of 3.5 per cent from its February statement on monetary policy, though the task of bringing inflation back within the 2 per cent to 3 per cent target band is expected to become much harder in the months ahead.