Wage growth drives inflation, average pay tops $100k

“The Reserve Bank needs labour productivity to improve and wages growth to come down to hit its inflation forecast. If either of those things proves incorrect, then inflation will prove to be too strong,” Ms Murphy said.

“It definitely suggests the Reserve Bank could keep rates higher for longer, and that’s exactly why Michele Bullock is using cautious language.”

While the risk of a wage-price spiral has dissipated, the issue now facing the central bank is entrenched wage growth above 3.5 per cent, which would make it impossible to get inflation back to the 2 per cent to 3 per cent target band. Wages growth of 3.5 per cent allows 2.5 per cent to be passed on to final consumer prices with an additional 1 per cent from productivity gains.

Interest rates ‘historically low’

Jonathan Kearns, chief economist at funds manager Challenger and the Reserve Bank’s former head of domestic markets, said he was sceptical productivity would pick up as assumed by his former employer.

“Given we are in a situation where inflation will be driven by labour costs, there is a risk we will get inflation sticky above 2.5 per cent and there is a risk we don’t get inflation under 3 per cent,” Mr Kearns said.

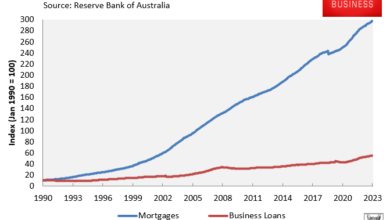

The RBA veteran added there was a strong case that interest rates were still low by historical standards and compared to peer nations.

“That means there is less disinflationary impetus in the system than you would ideally want,” he said.

“Based on the RBA’s current forecasts, if they turned out to be right, inflation will have been above 3 per cent for four years. That increases the risk wages expect higher inflation, contracts are priced with higher inflation, and you get the stickiness of higher inflation being ingrained in the system.”

Wages grew by 4.2 per cent in the year to December 31, according to the Australian Bureau of Statistics, slightly higher than market expectations of 4.1 per cent, above the RBA’s forecasts, and at the highest level since 2009.

The strength of the result was largely from public servant salaries growing at the fastest pace in 14 years after state premiers abandoned salary caps following pressure from unions and essential workers.

The average full-time adult employee earned $1,953.70 a week in November, equivalent to $101,592 a year, according to ABS on Thursday. The result, based on seasonally adjusted data, follows annual growth in ordinary time full-time earnings of 4.5 per cent, the strongest uplift since May 2013.

The strong growth in take-home pays comes after a series of landmark deals, including a 25 per cent pay rise over three years for DP World stevedore, and 6 per cent a year for some Queensland construction workers.

Nuanced inflation challenge

Prime Minister Anthony Albanese on Sunday lauded recent wages results.

“[Wages] grew much faster than was predicted by Treasury with that 4.2 per cent figure of wage growth, with inflation coming down,” he said on Sunday while campaigning in the Dunkley byelection.

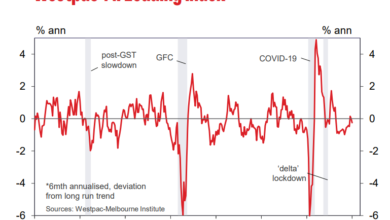

Ms Murphy had a different interpretation. “My concern is we have been a little complacent about the labour market component of the CPI,” she said.

“Assuming the trend continued to the end of 2023 and into the 2024, which is a reasonable assumption, it shows the Reserve Bank is facing upwards pressure on inflation from the biggest component of inflation; labour costs.

“It may not be intense pressure, but it was still moving in the wrong direction up to the June quarter last year.”

Treasury in April last year used its inflation composition analysis to dismiss claims from the Greens, unions and the left-leaning Australia Institute that profiteering by local firms was the leading cause of high inflation.

In a briefing to Treasurer Jim Chalmers, Treasury presented a nuanced analysis of the challenge. It predicted pay rises would become the main driver of CPI, and increased competition sparked by the slowing economy would force businesses to absorb higher wages into lower profit margins.

“As supply shocks subside and inflation dynamics normalise, wages growth will again become the main driver of inflation, given that labour costs are, ordinarily, the largest cost for business,” said the treasury briefing, which was signed off at the time by Dr Sarah Hunter, Treasury’s former head of macroeconomics who recently moved to the RBA as chief economist.

The briefing said that while many businesses had, to date, been able to pass on rising costs, claims that price gouging by local firms was driving inflation were “inconsistent” with the data.