Brokers Issue Forecasts for Avis Budget Group, Inc.’s FY2026 Earnings (NASDAQ:CAR)

Avis Budget Group, Inc. (NASDAQ:CAR – Free Report) – Equities researchers at Zacks Research issued their FY2026 earnings per share estimates for Avis Budget Group in a research note issued to investors on Monday, March 4th. Zacks Research analyst S. Dey anticipates that the business services provider will post earnings per share of $14.15 for the year. The consensus estimate for Avis Budget Group’s current full-year earnings is $18.11 per share.

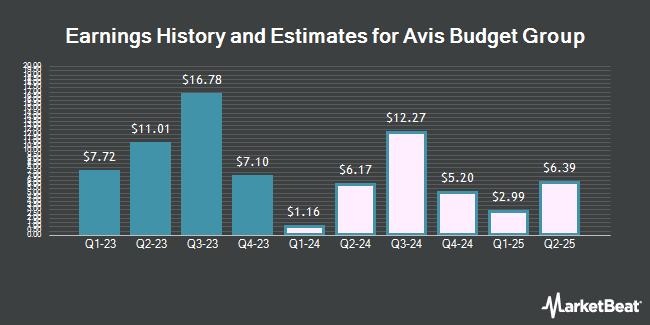

Avis Budget Group (NASDAQ:CAR – Get Free Report) last posted its earnings results on Tuesday, February 13th. The business services provider reported $7.10 earnings per share (EPS) for the quarter, beating the consensus estimate of $4.15 by $2.95. Avis Budget Group had a negative return on equity of 696.69% and a net margin of 13.59%. The company had revenue of $2.76 billion for the quarter, compared to analyst estimates of $2.81 billion. During the same quarter in the previous year, the firm earned $10.46 earnings per share. The firm’s quarterly revenue was down .3% compared to the same quarter last year.

Several other equities research analysts also recently weighed in on the company. Morgan Stanley lowered their price target on Avis Budget Group from $230.00 to $190.00 and set an “overweight” rating for the company in a report on Friday, February 23rd. The Goldman Sachs Group assumed coverage on Avis Budget Group in a report on Thursday, December 7th. They issued a “sell” rating and a $164.00 price target for the company. Deutsche Bank Aktiengesellschaft raised Avis Budget Group from a “hold” rating to a “buy” rating and raised their price target for the stock from $234.00 to $248.00 in a report on Thursday, January 25th. StockNews.com raised Avis Budget Group from a “sell” rating to a “hold” rating in a report on Monday, February 12th. Finally, JPMorgan Chase & Co. lowered their price target on Avis Budget Group from $280.00 to $240.00 and set an “overweight” rating for the company in a report on Wednesday, February 14th. One analyst has rated the stock with a sell rating, two have issued a hold rating and three have issued a buy rating to the company’s stock. Based on data from MarketBeat, the stock presently has an average rating of “Hold” and an average price target of $197.40.

Get Our Latest Analysis on Avis Budget Group

Avis Budget Group Price Performance

CAR opened at $106.45 on Tuesday. The business’s 50-day moving average is $150.89 and its two-hundred day moving average is $176.07. Avis Budget Group has a 1 year low of $99.60 and a 1 year high of $244.95. The firm has a market capitalization of $3.78 billion, a PE ratio of 2.50 and a beta of 2.21.

Insider Buying and Selling at Avis Budget Group

In other Avis Budget Group news, EVP Izilda P. Martins sold 3,950 shares of the business’s stock in a transaction that occurred on Friday, December 15th. The stock was sold at an average price of $195.86, for a total value of $773,647.00. Following the completion of the transaction, the executive vice president now directly owns 21,145 shares of the company’s stock, valued at $4,141,459.70. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, CEO Joseph A. Ferraro sold 18,460 shares of the business’s stock in a transaction that occurred on Friday, December 15th. The stock was sold at an average price of $195.41, for a total transaction of $3,607,268.60. Following the completion of the sale, the chief executive officer now directly owns 217,405 shares in the company, valued at $42,483,111.05. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, EVP Izilda P. Martins sold 3,950 shares of the business’s stock in a transaction that occurred on Friday, December 15th. The stock was sold at an average price of $195.86, for a total value of $773,647.00. Following the sale, the executive vice president now owns 21,145 shares of the company’s stock, valued at $4,141,459.70. The disclosure for this sale can be found here. 48.80% of the stock is currently owned by corporate insiders.

Institutional Trading of Avis Budget Group

Several large investors have recently made changes to their positions in CAR. HighTower Advisors LLC purchased a new stake in Avis Budget Group in the 1st quarter valued at $270,000. Great West Life Assurance Co. Can grew its holdings in Avis Budget Group by 8.1% in the 1st quarter. Great West Life Assurance Co. Can now owns 26,716 shares of the business services provider’s stock valued at $7,275,000 after buying an additional 1,999 shares in the last quarter. Bridgewater Associates LP grew its holdings in Avis Budget Group by 246.2% in the 1st quarter. Bridgewater Associates LP now owns 6,685 shares of the business services provider’s stock valued at $1,760,000 after buying an additional 4,754 shares in the last quarter. Federated Hermes Inc. grew its holdings in Avis Budget Group by 6.5% in the 1st quarter. Federated Hermes Inc. now owns 11,383 shares of the business services provider’s stock valued at $2,997,000 after buying an additional 696 shares in the last quarter. Finally, Utah Retirement Systems purchased a new stake in Avis Budget Group in the 1st quarter valued at $1,369,000. 98.26% of the stock is currently owned by hedge funds and other institutional investors.

Avis Budget Group Company Profile

Avis Budget Group, Inc, together with its subsidiaries, provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia. It operates the Avis brand, that offers vehicle rental and other mobility solutions to the premium commercial and leisure segments of the travel industry; the Budget Truck brand, a local, and one-way truck and cargo van rental businesses with a fleet of approximately 19,000 vehicles, which are rented through a network of approximately 415 dealer-operated and 390 company-operated locations that serve the light commercial and consumer sectors in the continental United States; and the Zipcar brand, a car sharing network.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Avis Budget Group, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Avis Budget Group wasn’t on the list.

While Avis Budget Group currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

Do you expect the global demand for energy to shrink?! If not, it’s time to take a look at how energy stocks can play a part in your portfolio.