Brokers Issue Forecasts for NVIDIA Co.’s Q1 2025 Earnings (NASDAQ:NVDA)

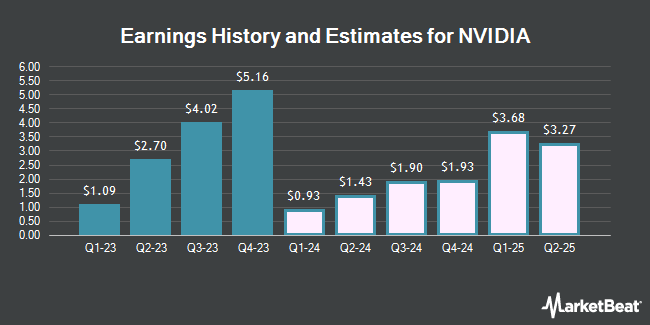

NVIDIA Co. (NASDAQ:NVDA – Free Report) – Equities research analysts at DA Davidson issued their Q1 2025 earnings per share estimates for NVIDIA in a research report issued to clients and investors on Thursday, February 22nd. DA Davidson analyst G. Luria expects that the computer hardware maker will post earnings of $5.65 per share for the quarter. DA Davidson currently has a “Neutral” rating and a $620.00 price target on the stock. The consensus estimate for NVIDIA’s current full-year earnings is $19.55 per share. DA Davidson also issued estimates for NVIDIA’s FY2025 earnings at $24.49 EPS and FY2026 earnings at $18.48 EPS.

Several other research firms have also issued reports on NVDA. Tigress Financial increased their target price on shares of NVIDIA from $560.00 to $790.00 and gave the stock a “buy” rating in a research note on Thursday, January 18th. The Goldman Sachs Group upped their price target on shares of NVIDIA from $800.00 to $875.00 and gave the stock a “buy” rating in a research report on Thursday. Stifel Nicolaus upped their price target on shares of NVIDIA from $865.00 to $910.00 and gave the stock a “buy” rating in a research report on Thursday. Edward Jones downgraded shares of NVIDIA from a “buy” rating to a “hold” rating in a report on Wednesday, November 22nd. Finally, JPMorgan Chase & Co. increased their price objective on shares of NVIDIA from $650.00 to $850.00 and gave the company an “overweight” rating in a report on Thursday. Four research analysts have rated the stock with a hold rating, thirty-six have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, NVIDIA has a consensus rating of “Moderate Buy” and an average price target of $820.03.

Read Our Latest Research Report on NVDA

NVIDIA Price Performance

NASDAQ:NVDA opened at $788.17 on Monday. NVIDIA has a one year low of $222.97 and a one year high of $823.94. The company has a debt-to-equity ratio of 0.20, a quick ratio of 3.06 and a current ratio of 4.17. The firm has a market cap of $1.97 trillion, a price-to-earnings ratio of 66.01, a PEG ratio of 2.44 and a beta of 1.69. The firm’s fifty day moving average is $597.38 and its two-hundred day moving average is $505.29.

NVIDIA (NASDAQ:NVDA – Get Free Report) last issued its quarterly earnings results on Wednesday, February 21st. The computer hardware maker reported $5.16 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $4.21 by $0.95. The business had revenue of $22.10 billion for the quarter, compared to the consensus estimate of $20.40 billion. NVIDIA had a return on equity of 93.61% and a net margin of 48.85%. The business’s quarterly revenue was up 265.3% on a year-over-year basis. During the same period in the prior year, the firm posted $0.65 earnings per share.

Hedge Funds Weigh In On NVIDIA

A number of institutional investors have recently modified their holdings of the company. Studio Investment Management LLC acquired a new position in NVIDIA during the fourth quarter worth approximately $27,000. LFA Lugano Financial Advisors SA purchased a new stake in NVIDIA during the fourth quarter worth approximately $28,000. Criterion Capital Advisors LLC purchased a new stake in NVIDIA during the fourth quarter worth approximately $28,000. Peoples Financial Services CORP. purchased a new stake in NVIDIA during the third quarter worth approximately $30,000. Finally, Your Advocates Ltd. LLP purchased a new stake in NVIDIA during the third quarter worth approximately $30,000. Institutional investors and hedge funds own 64.79% of the company’s stock.

Insider Activity

In related news, EVP Debora Shoquist sold 15,824 shares of the business’s stock in a transaction dated Wednesday, November 29th. The shares were sold at an average price of $482.42, for a total transaction of $7,633,814.08. Following the sale, the executive vice president now owns 74,036 shares of the company’s stock, valued at $35,716,447.12. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. In other news, insider Donald F. Robertson, Jr. sold 450 shares of the business’s stock in a transaction that occurred on Friday, January 5th. The shares were sold at an average price of $484.62, for a total value of $218,079.00. Following the completion of the transaction, the insider now owns 50,961 shares of the company’s stock, valued at $24,696,719.82. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Also, EVP Debora Shoquist sold 15,824 shares of the business’s stock in a transaction that occurred on Wednesday, November 29th. The shares were sold at an average price of $482.42, for a total transaction of $7,633,814.08. Following the completion of the transaction, the executive vice president now directly owns 74,036 shares of the company’s stock, valued at approximately $35,716,447.12. The disclosure for this sale can be found here. Insiders have sold a total of 124,998 shares of company stock valued at $65,236,422 over the last quarter. Corporate insiders own 3.99% of the company’s stock.

NVIDIA Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, March 27th. Stockholders of record on Wednesday, March 6th will be issued a $0.04 dividend. This represents a $0.16 annualized dividend and a dividend yield of 0.02%. The ex-dividend date is Tuesday, March 5th. NVIDIA’s payout ratio is 1.34%.

NVIDIA Company Profile

NVIDIA Corporation provides graphics, and compute and networking solutions in the United States, Taiwan, China, and internationally. The company’s Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building 3D designs and virtual worlds.

Further Reading

Receive News & Ratings for NVIDIA Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for NVIDIA and related companies with MarketBeat.com’s FREE daily email newsletter.