Brokers Offer Predictions for G1 Therapeutics, Inc.’s Q3 2024 Earnings (NASDAQ:GTHX)

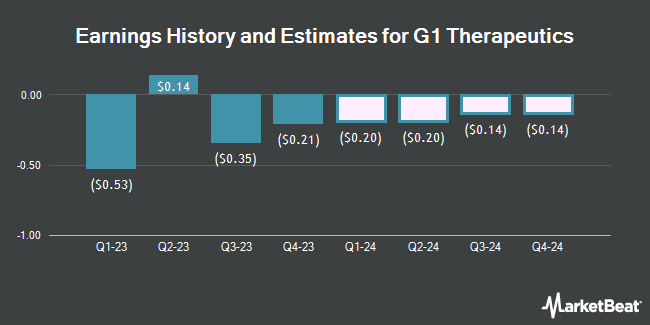

G1 Therapeutics, Inc. (NASDAQ:GTHX – Free Report) – Research analysts at Wedbush lifted their Q3 2024 earnings per share estimates for shares of G1 Therapeutics in a report issued on Wednesday, February 28th. Wedbush analyst D. Nierengarten now forecasts that the company will earn ($0.13) per share for the quarter, up from their previous estimate of ($0.14). Wedbush currently has a “Outperform” rating and a $5.00 target price on the stock. The consensus estimate for G1 Therapeutics’ current full-year earnings is ($0.82) per share. Wedbush also issued estimates for G1 Therapeutics’ Q4 2024 earnings at ($0.13) EPS, FY2024 earnings at ($0.65) EPS, FY2025 earnings at ($0.47) EPS, FY2026 earnings at ($0.35) EPS and FY2027 earnings at ($0.03) EPS.

Separately, Needham & Company LLC restated a “buy” rating and issued a $12.00 target price on shares of G1 Therapeutics in a report on Wednesday.

View Our Latest Research Report on GTHX

G1 Therapeutics Price Performance

Shares of NASDAQ GTHX opened at $3.73 on Friday. The firm has a 50-day simple moving average of $3.34 and a 200-day simple moving average of $2.29. The company has a quick ratio of 3.35, a current ratio of 3.75 and a debt-to-equity ratio of 1.19. The stock has a market capitalization of $193.36 million, a price-to-earnings ratio of -3.93 and a beta of 1.74. G1 Therapeutics has a 52 week low of $1.08 and a 52 week high of $5.00.

G1 Therapeutics (NASDAQ:GTHX – Get Free Report) last posted its quarterly earnings data on Wednesday, February 28th. The company reported ($0.21) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.27) by $0.06. G1 Therapeutics had a negative return on equity of 98.86% and a negative net margin of 58.13%. The company had revenue of $14.87 million for the quarter, compared to analysts’ expectations of $12.83 million. During the same period in the previous year, the firm posted ($0.73) EPS.

Insider Activity

In related news, insider Rajesh Malik sold 28,600 shares of G1 Therapeutics stock in a transaction on Monday, February 12th. The shares were sold at an average price of $4.62, for a total transaction of $132,132.00. Following the sale, the insider now directly owns 169,938 shares in the company, valued at approximately $785,113.56. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. In related news, CEO John E. (Jack) Jr. Bailey sold 32,983 shares of G1 Therapeutics stock in a transaction that occurred on Tuesday, January 2nd. The stock was sold at an average price of $3.27, for a total value of $107,854.41. Following the sale, the chief executive officer now directly owns 400,580 shares in the company, valued at $1,309,896.60. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. Also, insider Rajesh Malik sold 28,600 shares of the company’s stock in a transaction dated Monday, February 12th. The stock was sold at an average price of $4.62, for a total transaction of $132,132.00. Following the transaction, the insider now owns 169,938 shares in the company, valued at $785,113.56. The disclosure for this sale can be found here. In the last three months, insiders have sold 99,273 shares of company stock worth $367,243. 8.23% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On G1 Therapeutics

Several hedge funds and other institutional investors have recently bought and sold shares of GTHX. Swiss National Bank grew its position in shares of G1 Therapeutics by 9.1% in the first quarter. Swiss National Bank now owns 70,400 shares of the company’s stock valued at $535,000 after purchasing an additional 5,900 shares during the period. Raymond James & Associates boosted its holdings in shares of G1 Therapeutics by 72.0% in the 1st quarter. Raymond James & Associates now owns 397,879 shares of the company’s stock valued at $3,024,000 after purchasing an additional 166,564 shares during the last quarter. Raymond James Financial Services Advisors Inc. grew its stake in shares of G1 Therapeutics by 6.7% during the 1st quarter. Raymond James Financial Services Advisors Inc. now owns 53,625 shares of the company’s stock valued at $408,000 after buying an additional 3,383 shares during the period. MetLife Investment Management LLC grew its stake in shares of G1 Therapeutics by 56.5% during the 1st quarter. MetLife Investment Management LLC now owns 23,409 shares of the company’s stock valued at $178,000 after buying an additional 8,450 shares during the period. Finally, Dimensional Fund Advisors LP increased its holdings in shares of G1 Therapeutics by 7.9% during the 1st quarter. Dimensional Fund Advisors LP now owns 566,011 shares of the company’s stock worth $4,302,000 after buying an additional 41,278 shares during the last quarter. 30.04% of the stock is owned by institutional investors and hedge funds.

G1 Therapeutics Company Profile

G1 Therapeutics, Inc, a commercial-stage biopharmaceutical company, engages in the discovery, development, and commercialization of small molecule therapeutics for the treatment of patients with cancer. The company offers COSELA, which helps to decrease chemotherapy-induced myelosuppression in adult patients when administered prior to a platinum/etoposide-containing regimen or topotecan-containing regimen for extensive stage small cell lung cancer.

Recommended Stories

Receive News & Ratings for G1 Therapeutics Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for G1 Therapeutics and related companies with MarketBeat.com’s FREE daily email newsletter.