Brokers Offer Predictions for Guess?, Inc.’s Q1 2025 Earnings (NYSE:GES)

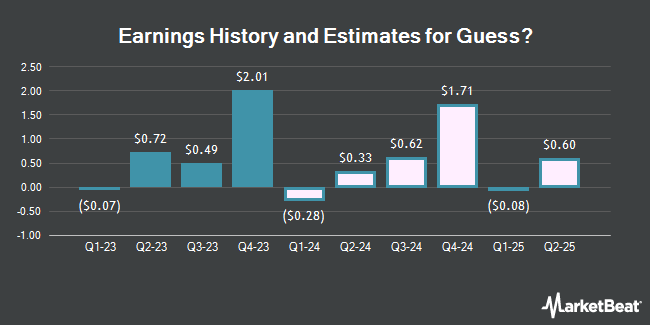

Guess?, Inc. (NYSE:GES – Free Report) – Stock analysts at B. Riley reduced their Q1 2025 earnings estimates for shares of Guess? in a research note issued on Monday, April 8th. B. Riley analyst J. Lick now expects that the company will earn ($0.29) per share for the quarter, down from their prior estimate of $0.10. B. Riley has a “Buy” rating and a $37.00 price objective on the stock. The consensus estimate for Guess?’s current full-year earnings is $2.91 per share. B. Riley also issued estimates for Guess?’s Q2 2025 earnings at $0.54 EPS, Q3 2025 earnings at $0.79 EPS, Q4 2025 earnings at $1.96 EPS, FY2025 earnings at $2.99 EPS, Q1 2026 earnings at ($0.22) EPS, Q2 2026 earnings at $0.67 EPS, Q3 2026 earnings at $0.90 EPS, Q4 2026 earnings at $2.08 EPS and FY2026 earnings at $3.43 EPS.

Guess? (NYSE:GES – Get Free Report) last issued its quarterly earnings data on Wednesday, March 20th. The company reported $2.01 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.55 by $0.46. Guess? had a net margin of 7.14% and a return on equity of 30.02%. The company had revenue of $891.05 million during the quarter, compared to the consensus estimate of $855.54 million. During the same quarter last year, the company earned $1.74 earnings per share. Guess?’s revenue for the quarter was up 9.0% on a year-over-year basis.

Several other equities analysts have also recently issued reports on GES. Telsey Advisory Group raised their price objective on Guess? from $23.00 to $30.00 and gave the stock a “market perform” rating in a research note on Thursday, March 21st. UBS Group raised their price objective on Guess? from $26.00 to $32.00 and gave the stock a “neutral” rating in a research note on Monday, March 25th. Jefferies Financial Group raised their price objective on Guess? from $24.00 to $29.00 and gave the stock a “hold” rating in a research note on Thursday, March 21st. Finally, StockNews.com upgraded Guess? from a “hold” rating to a “buy” rating in a research note on Friday, March 22nd. Three investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. According to MarketBeat.com, Guess? has a consensus rating of “Hold” and a consensus target price of $32.00.

View Our Latest Stock Report on Guess?

Guess? Stock Down 3.6 %

GES stock opened at $28.60 on Wednesday. Guess? has a twelve month low of $17.21 and a twelve month high of $33.50. The company has a current ratio of 1.55, a quick ratio of 0.96 and a debt-to-equity ratio of 0.50. The company has a market capitalization of $1.52 billion, a P/E ratio of 9.86 and a beta of 1.98. The firm has a 50 day simple moving average of $26.48 and a 200-day simple moving average of $23.85.

Institutional Investors Weigh In On Guess?

Hedge funds and other institutional investors have recently made changes to their positions in the company. Vanguard Group Inc. grew its stake in Guess? by 4.2% in the 1st quarter. Vanguard Group Inc. now owns 4,555,857 shares of the company’s stock valued at $99,546,000 after acquiring an additional 184,983 shares during the period. Dimensional Fund Advisors LP grew its stake in Guess? by 1.3% in the 1st quarter. Dimensional Fund Advisors LP now owns 3,970,545 shares of the company’s stock valued at $86,760,000 after acquiring an additional 50,371 shares during the period. State Street Corp grew its stake in Guess? by 2.2% in the 2nd quarter. State Street Corp now owns 1,499,678 shares of the company’s stock valued at $29,169,000 after acquiring an additional 32,367 shares during the period. LSV Asset Management lifted its holdings in Guess? by 5.0% in the 4th quarter. LSV Asset Management now owns 1,447,889 shares of the company’s stock valued at $33,388,000 after purchasing an additional 69,500 shares in the last quarter. Finally, Arrowstreet Capital Limited Partnership lifted its holdings in Guess? by 158.6% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 1,170,608 shares of the company’s stock valued at $24,220,000 after purchasing an additional 717,977 shares in the last quarter. Institutional investors and hedge funds own 61.74% of the company’s stock.

Insiders Place Their Bets

In other Guess? news, CEO Carlos Alberini sold 138,203 shares of the stock in a transaction dated Monday, April 8th. The shares were sold at an average price of $30.53, for a total transaction of $4,219,337.59. Following the completion of the sale, the chief executive officer now directly owns 1,131,575 shares of the company’s stock, valued at $34,546,984.75. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. 41.00% of the stock is owned by company insiders.

Guess? Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, May 3rd. Shareholders of record on Wednesday, April 17th will be given a $0.30 dividend. This represents a $1.20 annualized dividend and a yield of 4.20%. The ex-dividend date of this dividend is Tuesday, April 16th. Guess?’s dividend payout ratio (DPR) is presently 41.38%.

About Guess?

Guess?, Inc designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children. It operates through five segments: Americas Retail, Americas Wholesale, Europe, Asia, and Licensing. The company’s clothing collection includes jeans, pants, skirts, dresses, shorts, blouses, shirts, jackets, activewear, knitwear, and intimate apparel.

Further Reading

Receive News & Ratings for Guess? Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Guess? and related companies with MarketBeat.com’s FREE daily email newsletter.