Brokers Offer Predictions for Moelis & Company’s Q3 2024 Earnings (NYSE:MC)

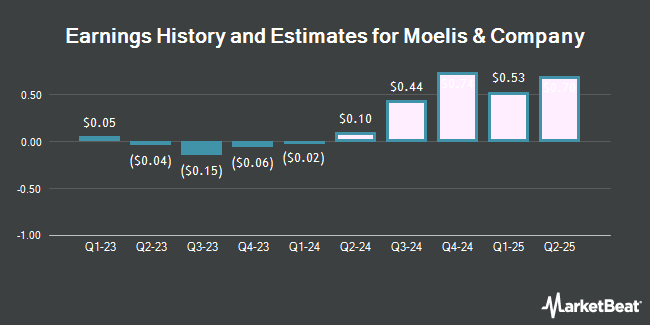

Moelis & Company (NYSE:MC – Free Report) – Equities researchers at Zacks Research cut their Q3 2024 earnings estimates for Moelis & Company in a research note issued to investors on Wednesday, February 28th. Zacks Research analyst R. Department now expects that the asset manager will earn $0.43 per share for the quarter, down from their previous estimate of $0.50. The consensus estimate for Moelis & Company’s current full-year earnings is $1.55 per share. Zacks Research also issued estimates for Moelis & Company’s Q1 2025 earnings at $0.53 EPS, Q3 2025 earnings at $0.66 EPS, Q4 2025 earnings at $0.89 EPS and FY2025 earnings at $2.78 EPS.

Moelis & Company (NYSE:MC – Get Free Report) last posted its quarterly earnings data on Wednesday, February 7th. The asset manager reported ($0.06) earnings per share for the quarter, topping the consensus estimate of ($0.11) by $0.05. Moelis & Company had a negative net margin of 2.89% and a negative return on equity of 3.82%. The company had revenue of $214.90 million for the quarter, compared to analysts’ expectations of $197.98 million. During the same period in the prior year, the business earned $0.33 earnings per share. Moelis & Company’s revenue for the quarter was up 3.7% compared to the same quarter last year.

A number of other research firms have also weighed in on MC. JPMorgan Chase & Co. increased their price objective on Moelis & Company from $46.00 to $57.00 and gave the company a “neutral” rating in a research note on Thursday, February 8th. Keefe, Bruyette & Woods reaffirmed a “market perform” rating and issued a $56.00 price target on shares of Moelis & Company in a research note on Monday, January 29th. Morgan Stanley dropped their price target on Moelis & Company from $39.00 to $38.00 and set an “underweight” rating for the company in a research note on Friday, November 3rd. StockNews.com raised Moelis & Company from a “sell” rating to a “hold” rating in a research report on Thursday, February 8th. Finally, The Goldman Sachs Group raised their price objective on Moelis & Company from $41.00 to $47.00 and gave the company a “sell” rating in a research report on Tuesday, December 19th. Three analysts have rated the stock with a sell rating and three have given a hold rating to the company’s stock. Based on data from MarketBeat.com, Moelis & Company has a consensus rating of “Hold” and a consensus target price of $45.60.

Get Our Latest Stock Analysis on MC

Moelis & Company Price Performance

Shares of NYSE MC opened at $53.60 on Friday. Moelis & Company has a one year low of $33.87 and a one year high of $58.67. The firm’s 50 day simple moving average is $55.00 and its two-hundred day simple moving average is $49.23. The stock has a market capitalization of $3.81 billion, a P/E ratio of -148.89 and a beta of 1.37.

Institutional Trading of Moelis & Company

Hedge funds and other institutional investors have recently bought and sold shares of the stock. First Capital Advisors Group LLC. purchased a new stake in Moelis & Company during the 2nd quarter valued at $26,000. Mendota Financial Group LLC purchased a new stake in Moelis & Company during the 4th quarter valued at $34,000. GAMMA Investing LLC purchased a new stake in Moelis & Company during the 4th quarter valued at $34,000. Tower Research Capital LLC TRC increased its stake in Moelis & Company by 380.1% in the first quarter. Tower Research Capital LLC TRC now owns 1,378 shares of the asset manager’s stock worth $53,000 after purchasing an additional 1,091 shares during the period. Finally, Covestor Ltd increased its stake in Moelis & Company by 230.3% in the first quarter. Covestor Ltd now owns 1,539 shares of the asset manager’s stock worth $72,000 after purchasing an additional 1,073 shares during the period. Hedge funds and other institutional investors own 91.53% of the company’s stock.

Insiders Place Their Bets

In other news, CEO Kenneth Moelis sold 75,000 shares of the stock in a transaction that occurred on Thursday, February 29th. The stock was sold at an average price of $54.11, for a total transaction of $4,058,250.00. Following the completion of the transaction, the chief executive officer now directly owns 86,441 shares in the company, valued at approximately $4,677,322.51. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In related news, CFO Joseph Simon sold 10,720 shares of the stock in a transaction on Friday, February 9th. The stock was sold at an average price of $54.70, for a total transaction of $586,384.00. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO Kenneth Moelis sold 75,000 shares of the stock in a transaction on Thursday, February 29th. The shares were sold at an average price of $54.11, for a total value of $4,058,250.00. Following the sale, the chief executive officer now owns 86,441 shares in the company, valued at approximately $4,677,322.51. The disclosure for this sale can be found here. Insiders sold 375,185 shares of company stock worth $20,130,225 in the last three months. 6.96% of the stock is owned by company insiders.

Moelis & Company Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, March 28th. Investors of record on Tuesday, February 20th will be paid a dividend of $0.60 per share. The ex-dividend date is Friday, February 16th. This represents a $2.40 dividend on an annualized basis and a dividend yield of 4.48%. Moelis & Company’s dividend payout ratio (DPR) is presently -666.67%.

Moelis & Company Company Profile

Moelis & Company operates as an investment banking advisory firm. It offers advisory services in the areas of mergers and acquisitions, recapitalizations and restructurings, capital markets transactions, and other corporate finance matters. The company offers its services to public multinational corporations, middle market private companies, financial sponsors, entrepreneurs, governments, and sovereign wealth funds.

See Also

Receive News & Ratings for Moelis & Company Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Moelis & Company and related companies with MarketBeat.com’s FREE daily email newsletter.