Brokers Offer Predictions for Ventyx Biosciences, Inc.’s Q1 2024 Earnings (NASDAQ:VTYX)

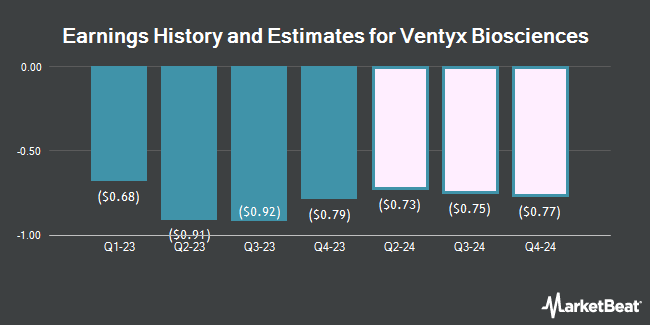

Ventyx Biosciences, Inc. (NASDAQ:VTYX – Free Report) – Research analysts at HC Wainwright issued their Q1 2024 earnings per share (EPS) estimates for Ventyx Biosciences in a report issued on Wednesday, February 28th. HC Wainwright analyst E. Bodnar anticipates that the company will post earnings per share of ($0.71) for the quarter. HC Wainwright currently has a “Neutral” rating on the stock. The consensus estimate for Ventyx Biosciences’ current full-year earnings is ($3.00) per share. HC Wainwright also issued estimates for Ventyx Biosciences’ FY2024 earnings at ($2.97) EPS, FY2025 earnings at ($2.74) EPS, FY2026 earnings at ($2.18) EPS, FY2027 earnings at ($1.92) EPS and FY2028 earnings at ($1.49) EPS.

Ventyx Biosciences (NASDAQ:VTYX – Get Free Report) last released its earnings results on Tuesday, February 27th. The company reported ($0.79) earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of ($0.87) by $0.08. During the same period in the previous year, the business earned ($0.62) earnings per share.

A number of other research analysts have also issued reports on VTYX. Morgan Stanley lowered Ventyx Biosciences from an “overweight” rating to an “equal weight” rating and decreased their target price for the company from $46.00 to $6.00 in a report on Tuesday, November 7th. Oppenheimer reiterated a “market perform” rating on shares of Ventyx Biosciences in a report on Wednesday, February 21st. Wells Fargo & Company lowered Ventyx Biosciences from an “overweight” rating to an “equal weight” rating and decreased their target price for the company from $77.00 to $8.00 in a report on Tuesday, November 7th. Evercore ISI restated an “in-line” rating and issued a $5.00 price target (down from $43.00) on shares of Ventyx Biosciences in a research note on Friday, November 10th. Finally, Lifesci Capital upgraded Ventyx Biosciences from a “market perform” rating to an “outperform” rating in a research note on Wednesday. Six equities research analysts have rated the stock with a hold rating and two have given a buy rating to the company’s stock. According to MarketBeat, Ventyx Biosciences presently has a consensus rating of “Hold” and an average target price of $27.86.

Read Our Latest Research Report on Ventyx Biosciences

Ventyx Biosciences Trading Up 20.1 %

NASDAQ:VTYX opened at $8.50 on Friday. The firm has a market cap of $503.63 million, a PE ratio of -2.58 and a beta of -1.06. The stock has a fifty day moving average price of $3.00 and a 200 day moving average price of $13.06. Ventyx Biosciences has a 12-month low of $1.87 and a 12-month high of $47.25.

Hedge Funds Weigh In On Ventyx Biosciences

Institutional investors have recently added to or reduced their stakes in the stock. UBS Group AG acquired a new position in Ventyx Biosciences in the 4th quarter valued at about $40,000. China Universal Asset Management Co. Ltd. boosted its holdings in Ventyx Biosciences by 96.3% in the 3rd quarter. China Universal Asset Management Co. Ltd. now owns 1,506 shares of the company’s stock valued at $52,000 after purchasing an additional 739 shares in the last quarter. Legal & General Group Plc boosted its holdings in Ventyx Biosciences by 152.3% in the 2nd quarter. Legal & General Group Plc now owns 2,422 shares of the company’s stock valued at $30,000 after purchasing an additional 1,462 shares in the last quarter. Metropolitan Life Insurance Co NY boosted its holdings in Ventyx Biosciences by 93.2% in the 2nd quarter. Metropolitan Life Insurance Co NY now owns 2,574 shares of the company’s stock valued at $84,000 after purchasing an additional 1,242 shares in the last quarter. Finally, Ameritas Investment Partners Inc. boosted its holdings in Ventyx Biosciences by 93.7% in the 2nd quarter. Ameritas Investment Partners Inc. now owns 3,865 shares of the company’s stock valued at $127,000 after purchasing an additional 1,870 shares in the last quarter.

Insider Transactions at Ventyx Biosciences

In other news, CEO Raju Mohan sold 58,860 shares of Ventyx Biosciences stock in a transaction dated Wednesday, December 20th. The stock was sold at an average price of $2.12, for a total transaction of $124,783.20. Following the sale, the chief executive officer now owns 1,570,719 shares in the company, valued at $3,329,924.28. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, CEO Raju Mohan sold 58,860 shares of Ventyx Biosciences stock in a transaction dated Wednesday, December 20th. The stock was sold at an average price of $2.12, for a total transaction of $124,783.20. Following the sale, the chief executive officer now owns 1,570,719 shares in the company, valued at $3,329,924.28. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider John Nuss sold 17,628 shares of Ventyx Biosciences stock in a transaction dated Wednesday, December 20th. The stock was sold at an average price of $2.12, for a total value of $37,371.36. Following the sale, the insider now owns 262,118 shares in the company, valued at approximately $555,690.16. The disclosure for this sale can be found here. Insiders own 24.39% of the company’s stock.

Ventyx Biosciences Company Profile

Ventyx Biosciences, Inc, a clinical-stage biopharmaceutical company, develops small molecule product candidates to address a range of inflammatory diseases. Its lead clinical product candidate is VTX958, a selective allosteric tyrosine kinase type 2 inhibitor for psoriasis, psoriatic arthritis, and Crohn’s disease.

See Also

Receive News & Ratings for Ventyx Biosciences Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Ventyx Biosciences and related companies with MarketBeat.com’s FREE daily email newsletter.