Brokers Set Expectations for Assured Guaranty Ltd.’s FY2024 Earnings (NYSE:AGO)

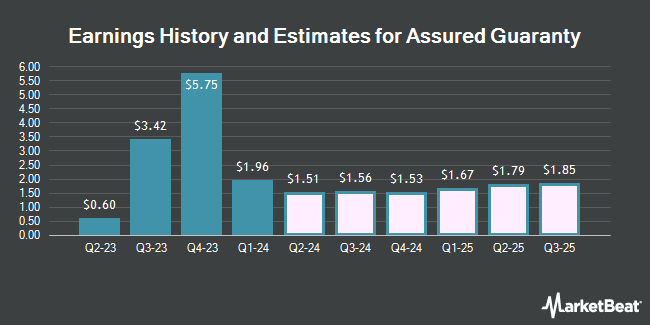

Assured Guaranty Ltd. (NYSE:AGO – Free Report) – Equities research analysts at Roth Capital lifted their FY2024 earnings estimates for shares of Assured Guaranty in a research report issued to clients and investors on Wednesday, May 8th. Roth Capital analyst H. Fong now forecasts that the financial services provider will earn $6.45 per share for the year, up from their previous forecast of $6.00. The consensus estimate for Assured Guaranty’s current full-year earnings is $6.00 per share. Roth Capital also issued estimates for Assured Guaranty’s Q1 2025 earnings at $1.67 EPS and Q3 2025 earnings at $1.85 EPS.

Several other research firms have also commented on AGO. UBS Group increased their target price on Assured Guaranty from $64.00 to $102.00 and gave the company a “neutral” rating in a report on Friday, March 1st. Keefe, Bruyette & Woods reiterated a “market perform” rating and issued a $92.00 price objective (up previously from $75.00) on shares of Assured Guaranty in a report on Monday, April 1st.

Read Our Latest Stock Report on AGO

Assured Guaranty Trading Down 2.5 %

NYSE AGO opened at $79.99 on Thursday. Assured Guaranty has a 12 month low of $49.84 and a 12 month high of $96.60. The firm’s 50-day moving average is $84.24 and its two-hundred day moving average is $77.55. The stock has a market capitalization of $4.44 billion, a P/E ratio of 6.45 and a beta of 1.14. The company has a debt-to-equity ratio of 0.29, a current ratio of 0.88 and a quick ratio of 0.88.

Assured Guaranty (NYSE:AGO – Get Free Report) last released its quarterly earnings data on Tuesday, May 7th. The financial services provider reported $1.96 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.41 by $0.55. Assured Guaranty had a net margin of 53.82% and a return on equity of 11.82%. The firm had revenue of $245.00 million during the quarter, compared to analysts’ expectations of $194.78 million. During the same period last year, the business earned $1.12 earnings per share. Assured Guaranty’s revenue was down 13.4% compared to the same quarter last year.

Hedge Funds Weigh In On Assured Guaranty

A number of hedge funds have recently modified their holdings of AGO. Householder Group Estate & Retirement Specialist LLC purchased a new stake in Assured Guaranty during the 4th quarter valued at approximately $28,000. Principal Securities Inc. acquired a new position in shares of Assured Guaranty in the fourth quarter valued at approximately $53,000. GAMMA Investing LLC purchased a new stake in shares of Assured Guaranty during the fourth quarter worth approximately $66,000. DekaBank Deutsche Girozentrale acquired a new stake in shares of Assured Guaranty during the third quarter worth $174,000. Finally, Atlas Capital Advisors LLC purchased a new position in Assured Guaranty in the 1st quarter valued at $182,000. 92.22% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Assured Guaranty

In other news, CEO Dominic Frederico sold 55,000 shares of Assured Guaranty stock in a transaction dated Wednesday, March 20th. The stock was sold at an average price of $92.43, for a total transaction of $5,083,650.00. Following the sale, the chief executive officer now owns 1,450,824 shares in the company, valued at $134,099,662.32. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 5.10% of the company’s stock.

Assured Guaranty Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, May 29th. Stockholders of record on Wednesday, May 15th will be issued a $0.31 dividend. This is a boost from Assured Guaranty’s previous quarterly dividend of $0.28. The ex-dividend date is Tuesday, May 14th. This represents a $1.24 annualized dividend and a dividend yield of 1.55%. Assured Guaranty’s dividend payout ratio is presently 10.00%.

About Assured Guaranty

Assured Guaranty Ltd., together with its subsidiaries, provides credit protection products to public finance, infrastructure, and structured finance markets in the United States and internationally. It operates through two segments: Insurance and Asset Management. The company offers financial guaranty insurance that protects holders of debt instruments and other monetary obligations from defaults in scheduled payments.

Featured Stories

Receive News & Ratings for Assured Guaranty Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Assured Guaranty and related companies with MarketBeat.com’s FREE daily email newsletter.