Brokers Set Expectations for Dynatrace, Inc.’s FY2024 Earnings (NYSE:DT)

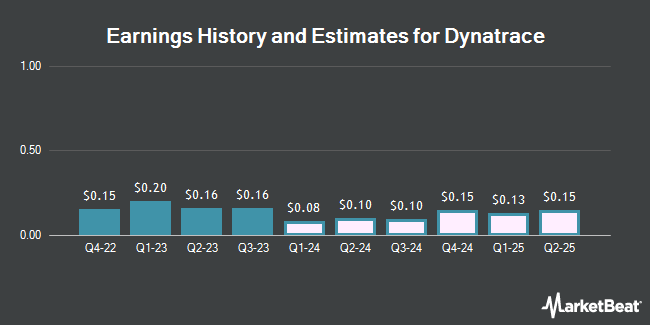

Dynatrace, Inc. (NYSE:DT – Free Report) – Analysts at Capital One Financial issued their FY2024 earnings per share estimates for shares of Dynatrace in a research note issued to investors on Wednesday, February 21st. Capital One Financial analyst C. Murphy anticipates that the company will post earnings of $0.62 per share for the year. Capital One Financial currently has a “Overweight” rating and a $64.00 target price on the stock. The consensus estimate for Dynatrace’s current full-year earnings is $0.62 per share. Capital One Financial also issued estimates for Dynatrace’s Q4 2024 earnings at $0.14 EPS, Q1 2025 earnings at $0.15 EPS, Q2 2025 earnings at $0.17 EPS, Q3 2025 earnings at $0.20 EPS, Q4 2025 earnings at $0.18 EPS and FY2025 earnings at $0.70 EPS.

DT has been the subject of several other reports. JMP Securities lifted their price objective on Dynatrace from $56.00 to $68.00 and gave the company a “market outperform” rating in a report on Friday, February 2nd. Jefferies Financial Group raised Dynatrace from a “hold” rating to a “buy” rating and lifted their price objective for the company from $50.00 to $70.00 in a report on Friday, January 5th. Scotiabank lifted their price objective on Dynatrace from $62.00 to $70.00 and gave the company a “sector outperform” rating in a report on Monday, February 5th. JPMorgan Chase & Co. dropped their price objective on Dynatrace from $69.00 to $65.00 and set an “overweight” rating for the company in a report on Friday, February 9th. Finally, Truist Financial lifted their price objective on Dynatrace from $60.00 to $70.00 and gave the company a “buy” rating in a report on Tuesday, January 16th. Three investment analysts have rated the stock with a hold rating and eighteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, Dynatrace has a consensus rating of “Moderate Buy” and a consensus price target of $60.63.

Check Out Our Latest Report on Dynatrace

Dynatrace Price Performance

DT opened at $50.01 on Monday. The company has a market capitalization of $14.80 billion, a PE ratio of 75.77, a price-to-earnings-growth ratio of 5.08 and a beta of 1.13. The business has a fifty day simple moving average of $55.20 and a 200 day simple moving average of $50.95. Dynatrace has a 1 year low of $37.21 and a 1 year high of $61.41.

Insiders Place Their Bets

In other Dynatrace news, insider Matthias Dollentz-Scharer sold 2,076 shares of the company’s stock in a transaction dated Friday, February 16th. The stock was sold at an average price of $51.91, for a total value of $107,765.16. Following the sale, the insider now owns 72,645 shares in the company, valued at approximately $3,771,001.95. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. In other Dynatrace news, insider Matthias Dollentz-Scharer sold 2,076 shares of the company’s stock in a transaction dated Friday, February 16th. The stock was sold at an average price of $51.91, for a total value of $107,765.16. Following the sale, the insider now owns 72,645 shares in the company, valued at approximately $3,771,001.95. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CEO Rick M. Mcconnell sold 1,991 shares of the company’s stock in a transaction dated Friday, February 16th. The shares were sold at an average price of $51.91, for a total value of $103,352.81. Following the completion of the sale, the chief executive officer now owns 514,106 shares in the company, valued at approximately $26,687,242.46. The disclosure for this sale can be found here. Insiders sold a total of 14,348,487 shares of company stock valued at $754,943,800 in the last 90 days. Corporate insiders own 0.54% of the company’s stock.

Institutional Investors Weigh In On Dynatrace

Institutional investors have recently made changes to their positions in the stock. Lindbrook Capital LLC grew its position in Dynatrace by 35.9% in the 4th quarter. Lindbrook Capital LLC now owns 708 shares of the company’s stock valued at $39,000 after purchasing an additional 187 shares during the period. Advisory Services Network LLC grew its position in Dynatrace by 50.9% in the 1st quarter. Advisory Services Network LLC now owns 661 shares of the company’s stock valued at $28,000 after purchasing an additional 223 shares during the period. 1492 Capital Management LLC grew its position in Dynatrace by 1.0% in the 4th quarter. 1492 Capital Management LLC now owns 23,144 shares of the company’s stock valued at $1,266,000 after purchasing an additional 224 shares during the period. Avior Wealth Management LLC grew its position in Dynatrace by 3.0% in the 3rd quarter. Avior Wealth Management LLC now owns 8,047 shares of the company’s stock valued at $376,000 after purchasing an additional 234 shares during the period. Finally, Meiji Yasuda Asset Management Co Ltd. grew its position in Dynatrace by 2.8% in the 3rd quarter. Meiji Yasuda Asset Management Co Ltd. now owns 8,905 shares of the company’s stock valued at $416,000 after purchasing an additional 240 shares during the period. Institutional investors own 94.28% of the company’s stock.

Dynatrace Company Profile

Dynatrace, Inc provides a security platform for multicloud environments. It operates Dynatrace, a security platform, which provides application and microservices monitoring, runtime application security, infrastructure monitoring, log management and analytics, digital experience monitoring, digital business analytics, and cloud automation.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dynatrace, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Dynatrace wasn’t on the list.

While Dynatrace currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You’d need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.