Brokers Set Expectations for Héroux-Devtek Inc.’s FY2026 Earnings (TSE:HRX)

Héroux-Devtek Inc. (TSE:HRX – Free Report) – Investment analysts at National Bank Financial issued their FY2026 earnings per share estimates for shares of Héroux-Devtek in a report issued on Monday, April 15th. National Bank Financial analyst C. Doerksen forecasts that the company will post earnings per share of $1.36 for the year. The consensus estimate for Héroux-Devtek’s current full-year earnings is $1.07 per share.

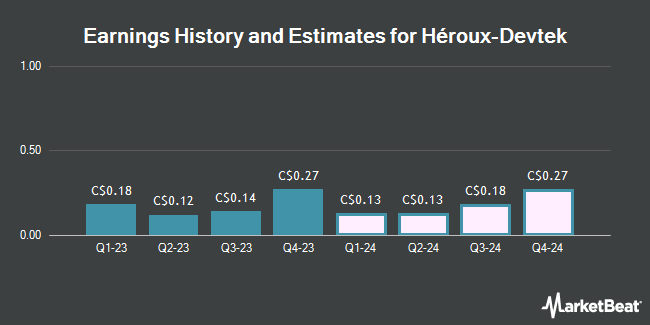

Héroux-Devtek (TSE:HRX – Get Free Report) last issued its quarterly earnings data on Wednesday, February 7th. The company reported C$0.27 earnings per share for the quarter, beating the consensus estimate of C$0.17 by C$0.10. Héroux-Devtek had a return on equity of 6.05% and a net margin of 3.97%. The business had revenue of C$163.52 million for the quarter, compared to analysts’ expectations of C$148.55 million.

Other equities analysts have also recently issued reports about the company. TD Securities upgraded Héroux-Devtek from a “hold” rating to a “buy” rating and raised their price objective for the company from C$19.00 to C$23.00 in a research note on Thursday, February 8th. National Bankshares lifted their target price on Héroux-Devtek from C$23.00 to C$25.00 and gave the stock an “outperform” rating in a research note on Tuesday. Desjardins lifted their target price on Héroux-Devtek from C$21.00 to C$26.00 and gave the stock a “buy” rating in a research note on Thursday, February 8th. Finally, Scotiabank lifted their target price on Héroux-Devtek from C$21.00 to C$22.50 and gave the stock an “outperform” rating in a research note on Wednesday, April 10th.

View Our Latest Stock Analysis on HRX

Héroux-Devtek Price Performance

Shares of TSE:HRX opened at C$19.60 on Wednesday. The company has a current ratio of 2.19, a quick ratio of 0.96 and a debt-to-equity ratio of 54.60. The stock’s fifty day simple moving average is C$18.35 and its two-hundred day simple moving average is C$16.42. Héroux-Devtek has a 1-year low of C$12.52 and a 1-year high of C$19.92. The stock has a market cap of C$659.54 million, a PE ratio of 28.00, a price-to-earnings-growth ratio of 1.02 and a beta of 1.63.

About Héroux-Devtek

Héroux-Devtek Inc engages in the design, development, manufacture, finishing, assembling, and repair and overhaul of aircraft landing gears, hydraulic and electromechanical flight control actuators, custom ball screws, and fracture-critical components. The company serves commercial and defence sectors of the aerospace market.

Recommended Stories

Receive News & Ratings for Héroux-Devtek Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Héroux-Devtek and related companies with MarketBeat.com’s FREE daily email newsletter.