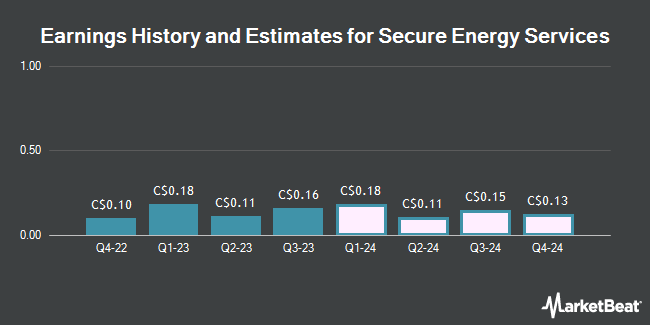

Brokers Set Expectations for Secure Energy Services Inc.’s FY2025 Earnings (TSE:SES)

Secure Energy Services Inc. (TSE:SES – Free Report) – National Bank Financial issued their FY2025 earnings per share estimates for shares of Secure Energy Services in a report issued on Monday, February 26th. National Bank Financial analyst P. Kenny anticipates that the company will post earnings per share of $0.85 for the year. The consensus estimate for Secure Energy Services’ current full-year earnings is $0.62 per share.

Other research analysts also recently issued research reports about the stock. Cormark raised their target price on shares of Secure Energy Services from C$12.00 to C$14.00 and gave the company a “buy” rating in a research report on Tuesday. National Bankshares boosted their price objective on shares of Secure Energy Services from C$12.00 to C$13.00 and gave the stock an “outperform” rating in a research note on Tuesday. CIBC increased their target price on Secure Energy Services from C$10.50 to C$11.00 and gave the company a “neutral” rating in a research report on Wednesday. Stifel Nicolaus boosted their price target on Secure Energy Services from C$11.25 to C$12.50 and gave the stock a “buy” rating in a research report on Tuesday. Finally, Raymond James lifted their target price on Secure Energy Services from C$13.00 to C$13.25 and gave the company an “outperform” rating in a research note on Tuesday. Three investment analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. According to MarketBeat, the company presently has an average rating of “Moderate Buy” and an average target price of C$11.88.

Read Our Latest Analysis on Secure Energy Services

Secure Energy Services Price Performance

SES opened at C$11.18 on Wednesday. The company has a current ratio of 1.14, a quick ratio of 1.10 and a debt-to-equity ratio of 91.79. The business’s fifty day simple moving average is C$10.14 and its 200-day simple moving average is C$8.56. The company has a market capitalization of C$3.23 billion, a price-to-earnings ratio of 20.33, a PEG ratio of 0.17 and a beta of 2.57. Secure Energy Services has a 12-month low of C$5.81 and a 12-month high of C$11.20.

Insider Activity at Secure Energy Services

In other Secure Energy Services news, Director Mark Bly acquired 20,000 shares of the firm’s stock in a transaction on Tuesday, December 12th. The stock was acquired at an average cost of C$8.36 per share, for a total transaction of C$167,218.00. In related news, Director Mark Bly acquired 20,000 shares of Secure Energy Services stock in a transaction on Tuesday, December 12th. The stock was acquired at an average price of C$8.36 per share, for a total transaction of C$167,218.00. Also, Senior Officer Allen Peter Gransch sold 3,920 shares of the firm’s stock in a transaction dated Wednesday, December 13th. The stock was sold at an average price of C$8.65, for a total value of C$33,903.69. 1.38% of the stock is owned by insiders.

Secure Energy Services Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, January 15th. Stockholders of record on Monday, January 1st were paid a $0.10 dividend. This represents a $0.40 annualized dividend and a dividend yield of 3.58%. The ex-dividend date of this dividend was Thursday, December 28th. Secure Energy Services’s payout ratio is 72.73%.

About Secure Energy Services

Secure Energy Services Inc, an energy services company, provides solutions to upstream oil and natural gas companies operating primarily in Canada and the United States. It operates through two segments, Midstream Infrastructure, and Environmental and Fluid Management. The Midstream Infrastructure segment provides processing, storing, shipping, and marketing of crude oil; and transports oil and water through pipelines, as well as engages in oil production processing and disposal, and water disposal; and crude oil emulsion treatment activities.

See Also

Receive News & Ratings for Secure Energy Services Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Secure Energy Services and related companies with MarketBeat.com’s FREE daily email newsletter.