Brokers Set Expectations for Viridian Therapeutics, Inc.’s Q1 2024 Earnings (NASDAQ:VRDN)

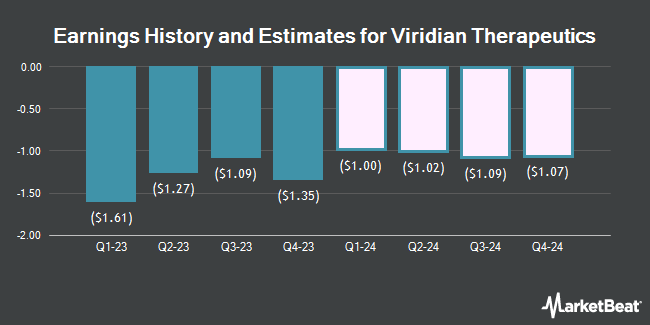

Viridian Therapeutics, Inc. (NASDAQ:VRDN – Free Report) – Equities research analysts at Wedbush reduced their Q1 2024 earnings per share (EPS) estimates for Viridian Therapeutics in a report issued on Wednesday, February 28th. Wedbush analyst L. Chico now forecasts that the company will post earnings of ($0.91) per share for the quarter, down from their prior forecast of ($0.81). Wedbush currently has a “Outperform” rating and a $40.00 target price on the stock. The consensus estimate for Viridian Therapeutics’ current full-year earnings is ($4.27) per share. Wedbush also issued estimates for Viridian Therapeutics’ Q2 2024 earnings at ($0.88) EPS, Q3 2024 earnings at ($0.88) EPS, Q4 2024 earnings at ($0.93) EPS, FY2024 earnings at ($3.61) EPS, FY2025 earnings at ($3.93) EPS, FY2026 earnings at ($4.06) EPS and FY2028 earnings at $12.47 EPS.

Other equities research analysts also recently issued research reports about the company. Oppenheimer boosted their price objective on Viridian Therapeutics from $35.00 to $36.00 and gave the company an “outperform” rating in a report on Tuesday, December 19th. Royal Bank of Canada restated an “outperform” rating and set a $35.00 price target on shares of Viridian Therapeutics in a report on Thursday, December 14th. HC Wainwright restated a “buy” rating and set a $37.00 price target on shares of Viridian Therapeutics in a report on Thursday. JMP Securities cut their price target on Viridian Therapeutics from $42.00 to $38.00 and set a “market outperform” rating on the stock in a report on Tuesday, November 14th. Finally, Needham & Company LLC restated a “buy” rating and set a $30.00 price target on shares of Viridian Therapeutics in a report on Wednesday. Ten investment analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock has an average rating of “Buy” and an average price target of $38.10.

Read Our Latest Analysis on VRDN

Viridian Therapeutics Price Performance

VRDN stock opened at $19.89 on Friday. The company has a current ratio of 18.26, a quick ratio of 13.93 and a debt-to-equity ratio of 0.09. The company has a market capitalization of $1.25 billion, a PE ratio of -3.74 and a beta of 1.10. Viridian Therapeutics has a 12-month low of $10.93 and a 12-month high of $33.31. The business’s fifty day moving average price is $20.27 and its 200 day moving average price is $17.65.

Viridian Therapeutics (NASDAQ:VRDN – Get Free Report) last released its quarterly earnings data on Tuesday, February 27th. The company reported ($1.35) earnings per share for the quarter, missing analysts’ consensus estimates of ($0.98) by ($0.37). Viridian Therapeutics had a negative return on equity of 121.80% and a negative net margin of 75,711.48%. The company had revenue of $0.07 million for the quarter, compared to analyst estimates of $0.15 million. During the same period last year, the firm posted ($1.13) EPS. The business’s quarterly revenue was down 31.4% on a year-over-year basis.

Institutional Trading of Viridian Therapeutics

Large investors have recently made changes to their positions in the company. Virtu Financial LLC acquired a new stake in Viridian Therapeutics during the 4th quarter worth approximately $424,000. Perceptive Advisors LLC lifted its position in Viridian Therapeutics by 71.1% during the 4th quarter. Perceptive Advisors LLC now owns 1,730,212 shares of the company’s stock worth $37,684,000 after acquiring an additional 719,007 shares during the period. Virtus ETF Advisers LLC lifted its holdings in shares of Viridian Therapeutics by 34.0% in the 4th quarter. Virtus ETF Advisers LLC now owns 4,787 shares of the company’s stock valued at $104,000 after buying an additional 1,215 shares during the period. Legal & General Group Plc lifted its holdings in shares of Viridian Therapeutics by 26.3% in the 4th quarter. Legal & General Group Plc now owns 34,566 shares of the company’s stock valued at $753,000 after buying an additional 7,206 shares during the period. Finally, Barclays PLC lifted its holdings in shares of Viridian Therapeutics by 66.9% in the 4th quarter. Barclays PLC now owns 219,593 shares of the company’s stock valued at $4,783,000 after buying an additional 88,036 shares during the period.

Insider Activity at Viridian Therapeutics

In other news, Director Fairmount Funds Management Llc bought 476,190 shares of the firm’s stock in a transaction that occurred on Monday, January 22nd. The stock was purchased at an average cost of $21.00 per share, with a total value of $9,999,990.00. Following the transaction, the director now directly owns 1,839,954 shares in the company, valued at $38,639,034. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Insiders own 1.43% of the company’s stock.

Viridian Therapeutics Company Profile

Viridian Therapeutics, Inc, a biotechnology company, discover and develops treatments for serious and rare diseases. The company’s product pipeline includes VRDN-001, a monoclonal antibody targeting insulin-like growth factor-1 receptor that is in Phase 3 clinical trial for the treatment of thyroid eye disease (TED); and VRDN-002 and VRDN-003, a next generation IGF-1R humanized monoclonal antibodies targeting IGF-1R and incorporating half-life extension technology for the treatment of TED.

See Also

Receive News & Ratings for Viridian Therapeutics Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Viridian Therapeutics and related companies with MarketBeat.com’s FREE daily email newsletter.