Daiwa Securities Group Inc. Sells 4,700 Shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR)

Daiwa Securities Group Inc. lessened its holdings in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 8.4% in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 51,344 shares of the financial services provider’s stock after selling 4,700 shares during the quarter. Daiwa Securities Group Inc.’s holdings in Interactive Brokers Group were worth $4,256,000 at the end of the most recent reporting period.

Daiwa Securities Group Inc. lessened its holdings in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 8.4% in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 51,344 shares of the financial services provider’s stock after selling 4,700 shares during the quarter. Daiwa Securities Group Inc.’s holdings in Interactive Brokers Group were worth $4,256,000 at the end of the most recent reporting period.

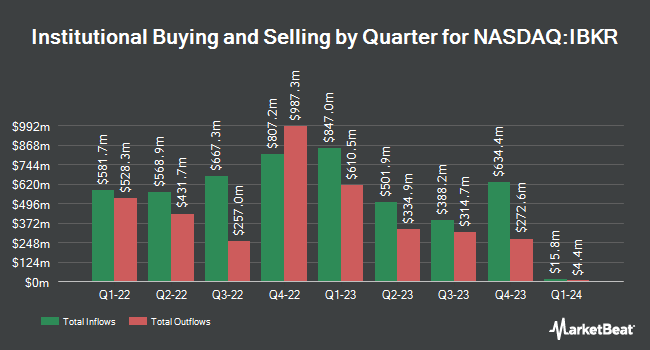

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Vanguard Group Inc. boosted its position in Interactive Brokers Group by 3.3% during the third quarter. Vanguard Group Inc. now owns 9,566,830 shares of the financial services provider’s stock worth $828,105,000 after purchasing an additional 308,236 shares during the period. BlackRock Inc. boosted its position in Interactive Brokers Group by 0.8% during the first quarter. BlackRock Inc. now owns 8,972,309 shares of the financial services provider’s stock worth $740,754,000 after purchasing an additional 69,018 shares during the period. Greenwich Wealth Management LLC boosted its position in Interactive Brokers Group by 6.5% during the third quarter. Greenwich Wealth Management LLC now owns 3,117,859 shares of the financial services provider’s stock worth $269,882,000 after purchasing an additional 189,555 shares during the period. State Street Corp boosted its position in Interactive Brokers Group by 2.8% during the second quarter. State Street Corp now owns 2,818,815 shares of the financial services provider’s stock worth $234,159,000 after purchasing an additional 76,695 shares during the period. Finally, Bank of America Corp DE boosted its position in Interactive Brokers Group by 26.0% during the first quarter. Bank of America Corp DE now owns 1,857,963 shares of the financial services provider’s stock worth $153,393,000 after purchasing an additional 383,027 shares during the period. Institutional investors own 23.80% of the company’s stock.

Wall Street Analysts Forecast Growth

IBKR has been the subject of a number of analyst reports. Barclays raised their price objective on shares of Interactive Brokers Group from $132.00 to $136.00 and gave the company an “overweight” rating in a research report on Wednesday. Piper Sandler raised their price objective on shares of Interactive Brokers Group from $105.00 to $125.00 and gave the company an “overweight” rating in a research report on Friday, April 12th. UBS Group cut their price objective on shares of Interactive Brokers Group from $108.00 to $104.00 and set a “buy” rating for the company in a research report on Tuesday, January 9th. Citigroup raised their price objective on shares of Interactive Brokers Group from $105.00 to $135.00 and gave the company a “buy” rating in a research report on Thursday, April 11th. Finally, The Goldman Sachs Group upgraded shares of Interactive Brokers Group from a “neutral” rating to a “buy” rating and raised their price objective for the company from $88.00 to $102.00 in a research report on Tuesday, January 9th. One research analyst has rated the stock with a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat.com, Interactive Brokers Group currently has a consensus rating of “Moderate Buy” and a consensus target price of $124.00.

View Our Latest Stock Analysis on Interactive Brokers Group

Insider Buying and Selling at Interactive Brokers Group

In other Interactive Brokers Group news, insider Thomas Aj Frank sold 50,300 shares of Interactive Brokers Group stock in a transaction that occurred on Monday, January 22nd. The shares were sold at an average price of $90.53, for a total transaction of $4,553,659.00. Following the completion of the sale, the insider now directly owns 445,352 shares in the company, valued at $40,317,716.56. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. In other Interactive Brokers Group news, insider Thomas Aj Frank sold 50,300 shares of Interactive Brokers Group stock in a transaction that occurred on Monday, January 22nd. The shares were sold at an average price of $90.53, for a total transaction of $4,553,659.00. Following the transaction, the insider now directly owns 445,352 shares of the company’s stock, valued at $40,317,716.56. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Vice Chairman Earl H. Nemser sold 74,218 shares of Interactive Brokers Group stock in a transaction that occurred on Friday, February 2nd. The stock was sold at an average price of $96.29, for a total transaction of $7,146,451.22. Following the transaction, the insider now directly owns 234,552 shares in the company, valued at $22,585,012.08. The disclosure for this sale can be found here. Insiders sold a total of 428,883 shares of company stock worth $40,395,135 over the last three months. 3.21% of the stock is owned by insiders.

Interactive Brokers Group Price Performance

Shares of Interactive Brokers Group stock opened at $111.55 on Friday. Interactive Brokers Group, Inc. has a 1 year low of $70.83 and a 1 year high of $116.92. The firm has a market cap of $46.97 billion, a PE ratio of 19.07, a PEG ratio of 1.12 and a beta of 0.83. The company has a 50 day simple moving average of $108.76 and a two-hundred day simple moving average of $92.90.

Interactive Brokers Group Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, June 14th. Shareholders of record on Friday, May 31st will be given a dividend of $0.25 per share. The ex-dividend date of this dividend is Friday, May 31st. This is a positive change from Interactive Brokers Group’s previous quarterly dividend of $0.10. This represents a $1.00 annualized dividend and a yield of 0.90%. Interactive Brokers Group’s payout ratio is presently 6.84%.

Interactive Brokers Group Company Profile

Interactive Brokers Group, Inc operates as an automated electronic broker worldwide. The company engages in the execution, clearance, and settlement of trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), precious metals, and cryptocurrencies.

See Also

Want to see what other hedge funds are holding IBKR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report).

Receive News & Ratings for Interactive Brokers Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Interactive Brokers Group and related companies with MarketBeat.com’s FREE daily email newsletter.