HC Wainwright Brokers Raise Earnings Estimates for Ocular Therapeutix, Inc. (NASDAQ:OCUL)

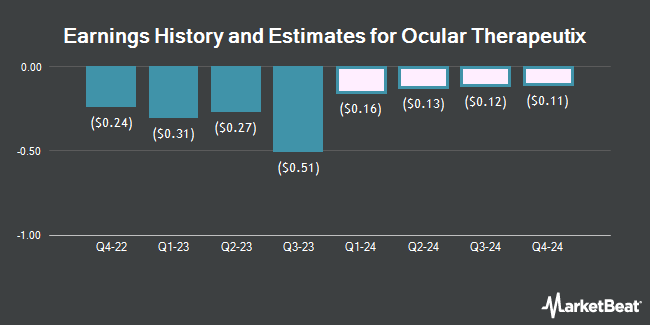

Ocular Therapeutix, Inc. (NASDAQ:OCUL – Free Report) – Investment analysts at HC Wainwright raised their Q1 2024 earnings per share (EPS) estimates for Ocular Therapeutix in a research note issued to investors on Wednesday, March 13th. HC Wainwright analyst Y. Chen now forecasts that the biopharmaceutical company will post earnings of ($0.16) per share for the quarter, up from their previous forecast of ($0.21). HC Wainwright currently has a “Buy” rating and a $12.00 price objective on the stock. The consensus estimate for Ocular Therapeutix’s current full-year earnings is ($0.80) per share. HC Wainwright also issued estimates for Ocular Therapeutix’s Q2 2024 earnings at ($0.13) EPS, Q3 2024 earnings at ($0.12) EPS, Q4 2024 earnings at ($0.11) EPS and FY2024 earnings at ($0.51) EPS.

A number of other equities research analysts have also recently weighed in on OCUL. StockNews.com cut Ocular Therapeutix from a “hold” rating to a “sell” rating in a research note on Sunday, March 10th. Piper Sandler raised their price target on Ocular Therapeutix from $10.00 to $15.00 and gave the company an “overweight” rating in a report on Monday, February 26th. Finally, Bank of America started coverage on Ocular Therapeutix in a research report on Friday, February 9th. They set a “buy” rating and a $15.00 price target for the company. One equities research analyst has rated the stock with a sell rating and four have given a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of “Moderate Buy” and a consensus target price of $14.40.

Check Out Our Latest Report on Ocular Therapeutix

Ocular Therapeutix Stock Up 2.2 %

OCUL stock opened at $9.46 on Monday. The company has a market cap of $751.30 million, a price-to-earnings ratio of -7.57 and a beta of 1.32. Ocular Therapeutix has a 12 month low of $2.00 and a 12 month high of $11.31. The company has a current ratio of 6.66, a quick ratio of 3.96 and a debt-to-equity ratio of 0.82. The firm has a 50-day moving average of $6.82 and a two-hundred day moving average of $4.46.

Insider Buying and Selling

In other Ocular Therapeutix news, CEO Antony C. Mattessich sold 18,338 shares of the company’s stock in a transaction that occurred on Wednesday, January 31st. The stock was sold at an average price of $4.95, for a total value of $90,773.10. Following the completion of the sale, the chief executive officer now directly owns 427,943 shares in the company, valued at $2,118,317.85. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other news, major shareholder Summer Road Llc acquired 930,851 shares of the company’s stock in a transaction dated Monday, February 26th. The stock was bought at an average price of $7.52 per share, with a total value of $6,999,999.52. Following the completion of the acquisition, the insider now owns 8,591,401 shares in the company, valued at approximately $64,607,335.52. The acquisition was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, CEO Antony C. Mattessich sold 18,338 shares of Ocular Therapeutix stock in a transaction on Wednesday, January 31st. The stock was sold at an average price of $4.95, for a total transaction of $90,773.10. Following the transaction, the chief executive officer now directly owns 427,943 shares in the company, valued at $2,118,317.85. The disclosure for this sale can be found here. Insiders sold 39,366 shares of company stock valued at $194,862 in the last three months. 5.50% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Ocular Therapeutix

Large investors have recently modified their holdings of the business. Summer Road LLC grew its stake in Ocular Therapeutix by 0.4% in the 4th quarter. Summer Road LLC now owns 6,122,089 shares of the biopharmaceutical company’s stock worth $17,203,000 after buying an additional 27,328 shares in the last quarter. BlackRock Inc. grew its position in Ocular Therapeutix by 7.0% during the 2nd quarter. BlackRock Inc. now owns 5,262,920 shares of the biopharmaceutical company’s stock valued at $27,157,000 after purchasing an additional 344,611 shares during the last quarter. Vanguard Group Inc. boosted its holdings in shares of Ocular Therapeutix by 26.0% during the 4th quarter. Vanguard Group Inc. now owns 5,118,102 shares of the biopharmaceutical company’s stock valued at $22,827,000 after acquiring an additional 1,057,123 shares during the last quarter. Franklin Resources Inc. purchased a new position in shares of Ocular Therapeutix in the fourth quarter worth approximately $20,071,000. Finally, Deltec Asset Management LLC raised its stake in Ocular Therapeutix by 18.5% during the 4th quarter. Deltec Asset Management LLC now owns 2,443,607 shares of the biopharmaceutical company’s stock worth $10,898,000 after acquiring an additional 381,810 shares during the period. Institutional investors own 54.42% of the company’s stock.

About Ocular Therapeutix

Ocular Therapeutix, Inc, a biopharmaceutical company, focuses on the formulation, development, and commercialization of therapies for diseases and conditions of the eye using its bioresorbable hydrogel-based formulation technology in the United States. The company markets DEXTENZA, a dexamethasone ophthalmic insert to treat post-surgical ocular inflammation and pain following ophthalmic surgery, as well as allergic conjunctivitis.

Read More

Receive News & Ratings for Ocular Therapeutix Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Ocular Therapeutix and related companies with MarketBeat.com’s FREE daily email newsletter.