Interactive Brokers Group, Inc. (NASDAQ:IBKR) Shares Sold by Kayne Anderson Rudnick Investment Management LLC

Kayne Anderson Rudnick Investment Management LLC cut its holdings in Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 15.8% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 6,371,599 shares of the financial services provider’s stock after selling 1,197,661 shares during the quarter. Interactive Brokers Group comprises approximately 1.6% of Kayne Anderson Rudnick Investment Management LLC’s portfolio, making the stock its 12th largest holding. Kayne Anderson Rudnick Investment Management LLC owned about 1.51% of Interactive Brokers Group worth $551,526,000 as of its most recent SEC filing.

Kayne Anderson Rudnick Investment Management LLC cut its holdings in Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 15.8% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 6,371,599 shares of the financial services provider’s stock after selling 1,197,661 shares during the quarter. Interactive Brokers Group comprises approximately 1.6% of Kayne Anderson Rudnick Investment Management LLC’s portfolio, making the stock its 12th largest holding. Kayne Anderson Rudnick Investment Management LLC owned about 1.51% of Interactive Brokers Group worth $551,526,000 as of its most recent SEC filing.

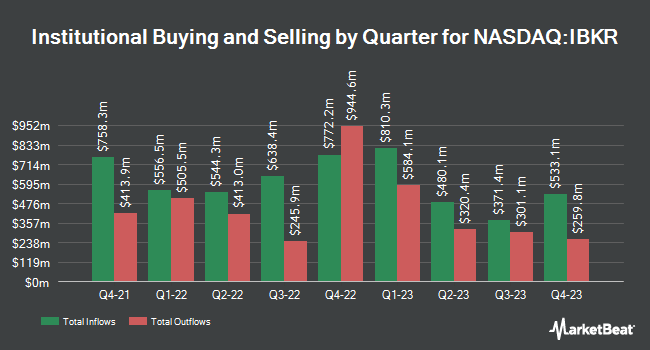

A number of other institutional investors also recently bought and sold shares of IBKR. Eagle Bay Advisors LLC acquired a new position in shares of Interactive Brokers Group during the second quarter worth about $31,000. Headlands Technologies LLC acquired a new position in shares of Interactive Brokers Group during the third quarter worth about $40,000. Atlas Capital Advisors LLC acquired a new position in shares of Interactive Brokers Group during the first quarter worth about $40,000. Steward Partners Investment Advisory LLC increased its stake in shares of Interactive Brokers Group by 496.0% during the fourth quarter. Steward Partners Investment Advisory LLC now owns 602 shares of the financial services provider’s stock worth $44,000 after acquiring an additional 501 shares during the period. Finally, Belpointe Asset Management LLC increased its stake in shares of Interactive Brokers Group by 64.5% during the first quarter. Belpointe Asset Management LLC now owns 579 shares of the financial services provider’s stock worth $48,000 after acquiring an additional 227 shares during the period. 21.56% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In related news, Vice Chairman Earl H. Nemser sold 74,218 shares of the company’s stock in a transaction that occurred on Friday, February 2nd. The shares were sold at an average price of $96.29, for a total transaction of $7,146,451.22. Following the completion of the transaction, the insider now owns 234,552 shares of the company’s stock, valued at $22,585,012.08. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. In related news, insider Thomas Aj Frank sold 50,300 shares of the company’s stock in a transaction that occurred on Monday, January 22nd. The shares were sold at an average price of $90.53, for a total transaction of $4,553,659.00. Following the completion of the transaction, the insider now owns 445,352 shares of the company’s stock, valued at $40,317,716.56. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Vice Chairman Earl H. Nemser sold 74,218 shares of the company’s stock in a transaction that occurred on Friday, February 2nd. The stock was sold at an average price of $96.29, for a total transaction of $7,146,451.22. Following the transaction, the insider now directly owns 234,552 shares of the company’s stock, valued at approximately $22,585,012.08. The disclosure for this sale can be found here. Insiders sold a total of 515,027 shares of company stock valued at $47,845,414 over the last 90 days. Insiders own 3.34% of the company’s stock.

Analyst Ratings Changes

A number of analysts recently commented on IBKR shares. UBS Group decreased their price objective on shares of Interactive Brokers Group from $108.00 to $104.00 and set a “buy” rating on the stock in a report on Tuesday, January 9th. Redburn Atlantic started coverage on shares of Interactive Brokers Group in a report on Friday, December 1st. They set a “buy” rating and a $100.00 price objective on the stock. Finally, The Goldman Sachs Group raised shares of Interactive Brokers Group from a “neutral” rating to a “buy” rating and boosted their price objective for the stock from $88.00 to $102.00 in a report on Tuesday, January 9th. One equities research analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company’s stock. According to data from MarketBeat, the company has a consensus rating of “Moderate Buy” and an average price target of $110.38.

Read Our Latest Report on IBKR

Interactive Brokers Group Price Performance

Shares of NASDAQ IBKR traded up $0.59 on Thursday, hitting $105.65. The company’s stock had a trading volume of 383,245 shares, compared to its average volume of 1,447,313. The stock has a 50 day moving average of $90.12 and a 200-day moving average of $87.30. The company has a market capitalization of $44.48 billion, a price-to-earnings ratio of 18.84, a price-to-earnings-growth ratio of 0.95 and a beta of 0.80. Interactive Brokers Group, Inc. has a 12-month low of $70.83 and a 12-month high of $107.20.

Interactive Brokers Group (NASDAQ:IBKR – Get Free Report) last posted its quarterly earnings data on Tuesday, January 16th. The financial services provider reported $1.52 earnings per share for the quarter, missing analysts’ consensus estimates of $1.53 by ($0.01). The firm had revenue of $1.14 billion during the quarter, compared to analyst estimates of $1.14 billion. Interactive Brokers Group had a net margin of 7.72% and a return on equity of 4.66%. The business’s quarterly revenue was up 16.7% on a year-over-year basis. During the same period in the prior year, the firm earned $1.30 EPS. Sell-side analysts expect that Interactive Brokers Group, Inc. will post 6.07 EPS for the current fiscal year.

Interactive Brokers Group Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, March 14th. Stockholders of record on Friday, March 1st will be given a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a dividend yield of 0.38%. The ex-dividend date of this dividend is Thursday, February 29th. Interactive Brokers Group’s dividend payout ratio is presently 7.07%.

Interactive Brokers Group Profile

Interactive Brokers Group, Inc operates as an automated electronic broker worldwide. The company specializes in routing, executing, and processing trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), metals, and cryptocurrencies. It also custodies and services accounts for hedge and mutual funds, ETFs, registered investment advisors, proprietary trading groups, introducing brokers, and individual investors.

Featured Stories

Want to see what other hedge funds are holding IBKR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Interactive Brokers Group, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Interactive Brokers Group wasn’t on the list.

While Interactive Brokers Group currently has a “Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.