Raymond James Brokers Boost Earnings Estimates for OceanaGold Co. (TSE:OGC)

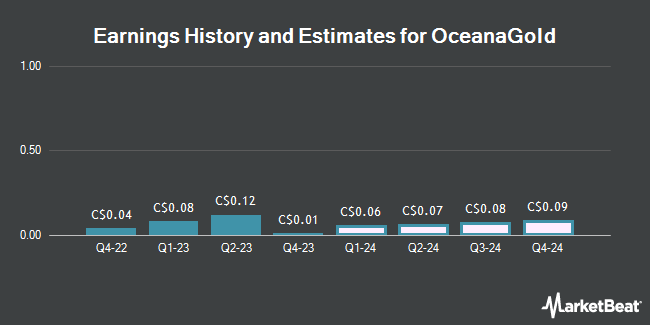

OceanaGold Co. (TSE:OGC – Free Report) – Research analysts at Raymond James boosted their Q4 2024 EPS estimates for OceanaGold in a note issued to investors on Tuesday, March 19th. Raymond James analyst F. Hamed now forecasts that the company will post earnings per share of $0.09 for the quarter, up from their previous forecast of $0.08. Raymond James currently has a “Outperform” rating and a $4.00 price target on the stock. The consensus estimate for OceanaGold’s current full-year earnings is $0.30 per share.

Several other equities analysts have also weighed in on OGC. Jefferies Financial Group set a C$3.50 target price on shares of OceanaGold and gave the company a “buy” rating in a report on Thursday, February 29th. BMO Capital Markets cut their target price on shares of OceanaGold from C$4.25 to C$3.75 in a research note on Thursday, February 22nd. National Bank Financial reaffirmed an “outperform overweight” rating on shares of OceanaGold in a research note on Wednesday, January 3rd. National Bankshares cut their target price on shares of OceanaGold from C$4.00 to C$3.75 in a research note on Friday, February 23rd. Finally, CIBC increased their price objective on shares of OceanaGold from C$4.50 to C$5.00 and gave the company an “outperform” rating in a research report on Wednesday, February 7th. Six analysts have rated the stock with a buy rating, According to MarketBeat.com, OceanaGold presently has an average rating of “Buy” and an average price target of C$3.88.

View Our Latest Analysis on OGC

OceanaGold Stock Down 1.1 %

OGC stock opened at C$2.80 on Friday. The stock has a market capitalization of C$1.98 billion, a PE ratio of 17.50 and a beta of 1.50. OceanaGold has a 52 week low of C$2.08 and a 52 week high of C$3.50. The stock’s 50-day moving average is C$2.64.

OceanaGold (TSE:OGC – Get Free Report) last released its quarterly earnings data on Wednesday, February 21st. The company reported C$0.01 earnings per share for the quarter, missing analysts’ consensus estimates of C$0.02 by C($0.01). OceanaGold had a net margin of 8.10% and a return on equity of 4.88%. The firm had revenue of C$363.94 million during the quarter.

Insider Activity

In related news, Director Paul Benson bought 44,400 shares of the stock in a transaction dated Tuesday, February 27th. The stock was acquired at an average price of C$2.25 per share, for a total transaction of C$99,678.00. Company insiders own 0.14% of the company’s stock.

OceanaGold Dividend Announcement

The business also recently announced a Semi-Annual dividend, which will be paid on Friday, April 26th. Stockholders of record on Thursday, March 7th will be issued a $0.013 dividend. The ex-dividend date is Wednesday, March 6th. OceanaGold’s payout ratio is 18.75%.

About OceanaGold

OceanaGold Corporation, a gold producer, engages in exploration, development, and operation of mineral properties. It explores for gold, copper, and silver deposits. The company holds interest in the Didipio gold and copper project located in the Luzon, Philippines; the Macraes goldfield project in the South Island of New Zealand; Waihi gold project in the North Island of New Zealand; and the Haile gold project located in Kershaw, South Carolina, the United States.

Further Reading

Receive News & Ratings for OceanaGold Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for OceanaGold and related companies with MarketBeat.com’s FREE daily email newsletter.