Zacks Research Brokers Cut Earnings Estimates for Cintas Co. (NASDAQ:CTAS)

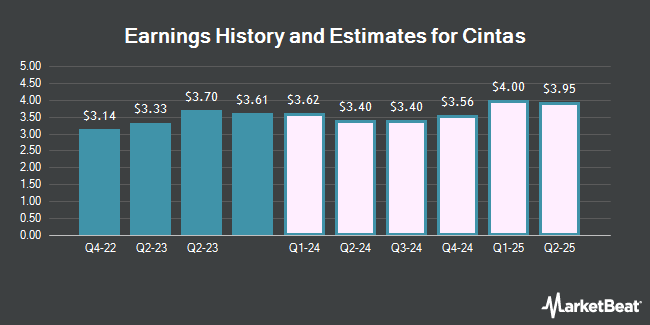

Cintas Co. (NASDAQ:CTAS – Free Report) – Equities research analysts at Zacks Research dropped their Q3 2025 earnings estimates for Cintas in a report issued on Monday, February 5th. Zacks Research analyst R. Department now anticipates that the business services provider will earn $3.94 per share for the quarter, down from their prior estimate of $3.95. The consensus estimate for Cintas’ current full-year earnings is $14.57 per share. Zacks Research also issued estimates for Cintas’ Q1 2026 earnings at $4.39 EPS.

Several other equities research analysts have also issued reports on CTAS. Stifel Nicolaus increased their target price on shares of Cintas from $526.00 to $585.00 and gave the stock a “hold” rating in a report on Friday, December 22nd. Royal Bank of Canada raised their price objective on shares of Cintas from $525.00 to $645.00 and gave the company an “outperform” rating in a research report on Friday, December 22nd. Truist Financial raised their price objective on Cintas from $645.00 to $660.00 and gave the company a “buy” rating in a research report on Thursday, January 25th. StockNews.com raised Cintas from a “hold” rating to a “buy” rating in a research note on Friday, December 29th. Finally, JPMorgan Chase & Co. lifted their price objective on Cintas from $540.00 to $640.00 and gave the stock an “overweight” rating in a research note on Friday, December 22nd. Six analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the company’s stock. Based on data from MarketBeat.com, the company has an average rating of “Moderate Buy” and a consensus target price of $560.57.

Read Our Latest Stock Report on Cintas

Cintas Stock Performance

Shares of CTAS opened at $617.89 on Wednesday. Cintas has a 52 week low of $425.00 and a 52 week high of $622.63. The company has a quick ratio of 1.89, a current ratio of 2.24 and a debt-to-equity ratio of 0.62. The stock has a market cap of $62.64 billion, a price-to-earnings ratio of 44.84, a PEG ratio of 3.57 and a beta of 1.28. The business has a 50-day simple moving average of $584.64 and a two-hundred day simple moving average of $535.07.

Cintas (NASDAQ:CTAS – Get Free Report) last posted its quarterly earnings data on Thursday, December 21st. The business services provider reported $3.61 EPS for the quarter, topping the consensus estimate of $3.49 by $0.12. The firm had revenue of $2.38 billion during the quarter, compared to analyst estimates of $2.34 billion. Cintas had a return on equity of 36.78% and a net margin of 15.57%. Cintas’s revenue was up 9.3% on a year-over-year basis. During the same period in the prior year, the business posted $3.12 EPS.

Institutional Trading of Cintas

A number of hedge funds and other institutional investors have recently bought and sold shares of CTAS. Columbus Macro LLC lifted its holdings in Cintas by 1.2% during the 4th quarter. Columbus Macro LLC now owns 1,453 shares of the business services provider’s stock valued at $871,000 after buying an additional 17 shares in the last quarter. Quent Capital LLC increased its position in shares of Cintas by 22.8% during the fourth quarter. Quent Capital LLC now owns 97 shares of the business services provider’s stock worth $59,000 after acquiring an additional 18 shares during the period. Greenleaf Trust raised its stake in shares of Cintas by 1.0% during the third quarter. Greenleaf Trust now owns 1,899 shares of the business services provider’s stock valued at $913,000 after acquiring an additional 19 shares in the last quarter. Catalyst Capital Advisors LLC boosted its holdings in shares of Cintas by 33.9% in the third quarter. Catalyst Capital Advisors LLC now owns 75 shares of the business services provider’s stock valued at $36,000 after purchasing an additional 19 shares during the period. Finally, Silver Oak Securities Incorporated grew its stake in Cintas by 3.3% in the second quarter. Silver Oak Securities Incorporated now owns 635 shares of the business services provider’s stock worth $316,000 after purchasing an additional 20 shares in the last quarter. Hedge funds and other institutional investors own 62.26% of the company’s stock.

Insider Activity

In other Cintas news, CFO J. Michael Hansen sold 9,774 shares of the firm’s stock in a transaction dated Friday, December 22nd. The shares were sold at an average price of $596.91, for a total value of $5,834,198.34. Following the completion of the sale, the chief financial officer now owns 37,732 shares of the company’s stock, valued at $22,522,608.12. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Insiders own 14.90% of the company’s stock.

Cintas Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, March 15th. Shareholders of record on Thursday, February 15th will be given a dividend of $1.35 per share. This represents a $5.40 dividend on an annualized basis and a yield of 0.87%. The ex-dividend date of this dividend is Wednesday, February 14th. Cintas’s dividend payout ratio (DPR) is 39.19%.

About Cintas

Cintas Corporation provides corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America. It operates through Uniform Rental and Facility Services, First Aid and Safety Services, and All Other segments. The company rents and services uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items; and provides restroom cleaning services and supplies, as well as sells uniforms.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cintas, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Cintas wasn’t on the list.

While Cintas currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s list of seven best retirement stocks and why they should be in your portfolio.