William Blair Brokers Reduce Earnings Estimates for American Public Education, Inc. (NASDAQ:APEI)

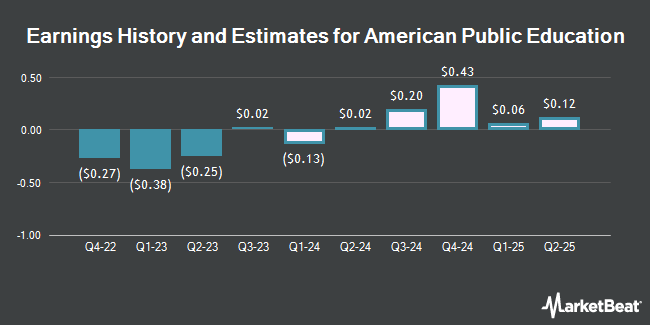

American Public Education, Inc. (NASDAQ:APEI – Free Report) – Research analysts at William Blair reduced their Q2 2024 EPS estimates for shares of American Public Education in a research note issued to investors on Wednesday, March 6th. William Blair analyst S. Sheldon now anticipates that the company will earn $0.03 per share for the quarter, down from their previous estimate of $0.08. The consensus estimate for American Public Education’s current full-year earnings is $0.56 per share. William Blair also issued estimates for American Public Education’s Q3 2024 earnings at $0.29 EPS, Q4 2024 earnings at $0.63 EPS, FY2024 earnings at $0.94 EPS and FY2025 earnings at $1.33 EPS.

A number of other research firms have also weighed in on APEI. Truist Financial lifted their price objective on shares of American Public Education from $6.00 to $15.00 and gave the company a “hold” rating in a research note on Wednesday. Barrington Research boosted their price target on shares of American Public Education from $8.00 to $15.00 and gave the stock an “outperform” rating in a research note on Wednesday. StockNews.com raised shares of American Public Education from a “buy” rating to a “strong-buy” rating in a research note on Friday, November 10th. Finally, B. Riley reiterated a “buy” rating and set a $15.00 price target (up previously from $12.00) on shares of American Public Education in a research report on Wednesday. Two analysts have rated the stock with a hold rating, two have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, American Public Education currently has an average rating of “Moderate Buy” and a consensus target price of $15.00.

View Our Latest Stock Report on APEI

American Public Education Stock Performance

Shares of APEI opened at $12.29 on Friday. American Public Education has a one year low of $3.76 and a one year high of $16.39. The stock has a 50-day moving average of $11.26 and a 200-day moving average of $7.84. The company has a debt-to-equity ratio of 0.38, a current ratio of 2.94 and a quick ratio of 2.47. The company has a market cap of $215.08 million, a PE ratio of -4.18, a P/E/G ratio of 1.87 and a beta of 1.25.

Institutional Investors Weigh In On American Public Education

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. State of Wyoming bought a new stake in American Public Education during the 4th quarter valued at about $29,000. Lazard Asset Management LLC bought a new stake in shares of American Public Education in the 1st quarter valued at about $108,000. UBS Group AG raised its holdings in shares of American Public Education by 222.5% in the 4th quarter. UBS Group AG now owns 5,772 shares of the company’s stock valued at $71,000 after purchasing an additional 3,982 shares in the last quarter. MetLife Investment Management LLC raised its holdings in shares of American Public Education by 46.6% in the 1st quarter. MetLife Investment Management LLC now owns 9,417 shares of the company’s stock valued at $200,000 after purchasing an additional 2,995 shares in the last quarter. Finally, Tower Research Capital LLC TRC raised its holdings in shares of American Public Education by 1,169.3% in the 1st quarter. Tower Research Capital LLC TRC now owns 9,837 shares of the company’s stock valued at $53,000 after purchasing an additional 9,062 shares in the last quarter. Institutional investors own 81.53% of the company’s stock.

About American Public Education

American Public Education, Inc, together with its subsidiaries, provides online and campus-based postsecondary education and career learning. It operates through three segments: American Public University System, Rasmussen University, and Hondros College of Nursing. The company offers 136 degree programs and 115 certificate programs in various fields of study, including nursing, public health, public administration, and business administration.

Further Reading

Receive News & Ratings for American Public Education Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for American Public Education and related companies with MarketBeat.com’s FREE daily email newsletter.