Zacks Research Brokers Cut Earnings Estimates for Dr. Reddy’s Laboratories Limited (NYSE:RDY)

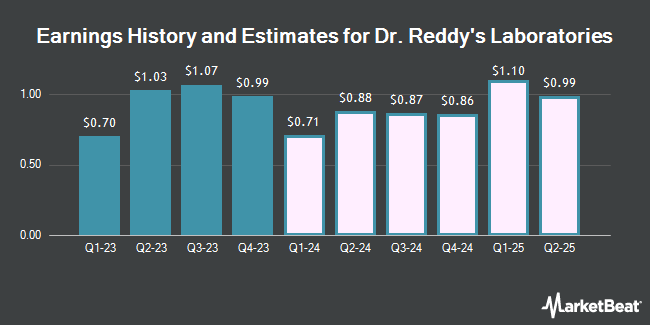

Dr. Reddy’s Laboratories Limited (NYSE:RDY – Free Report) – Equities research analysts at Zacks Research reduced their FY2026 earnings per share (EPS) estimates for shares of Dr. Reddy’s Laboratories in a research report issued on Tuesday, April 16th. Zacks Research analyst R. Department now forecasts that the company will post earnings of $4.11 per share for the year, down from their previous forecast of $4.12. The consensus estimate for Dr. Reddy’s Laboratories’ current full-year earnings is $3.96 per share.

Dr. Reddy’s Laboratories (NYSE:RDY – Get Free Report) last posted its quarterly earnings results on Wednesday, January 31st. The company reported $0.99 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.88 by $0.11. The business had revenue of $867.00 million during the quarter, compared to analyst estimates of $827.81 million. Dr. Reddy’s Laboratories had a return on equity of 20.97% and a net margin of 19.26%.

RDY has been the subject of several other reports. Barclays increased their price objective on Dr. Reddy’s Laboratories from $75.00 to $80.00 and gave the stock an “overweight” rating in a research report on Monday, January 29th. StockNews.com upgraded Dr. Reddy’s Laboratories from a “buy” rating to a “strong-buy” rating in a research report on Friday, April 5th. Finally, Jefferies Financial Group lowered Dr. Reddy’s Laboratories from a “buy” rating to an “underperform” rating in a research report on Thursday, January 11th. One analyst has rated the stock with a sell rating, two have assigned a hold rating, one has assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of “Hold” and a consensus target price of $80.00.

Get Our Latest Research Report on RDY

Dr. Reddy’s Laboratories Trading Down 0.3 %

Shares of Dr. Reddy’s Laboratories stock opened at $71.37 on Wednesday. The firm has a market capitalization of $11.91 billion, a price-to-earnings ratio of 18.83, a PEG ratio of 1.77 and a beta of 0.58. Dr. Reddy’s Laboratories has a fifty-two week low of $53.12 and a fifty-two week high of $77.72. The company has a debt-to-equity ratio of 0.02, a quick ratio of 1.90 and a current ratio of 2.55. The stock has a 50 day moving average of $74.54 and a 200 day moving average of $70.17.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of the company. Artemis Investment Management LLP purchased a new position in shares of Dr. Reddy’s Laboratories during the first quarter worth $594,000. Janiczek Wealth Management LLC boosted its position in shares of Dr. Reddy’s Laboratories by 39.2% during the first quarter. Janiczek Wealth Management LLC now owns 6,177 shares of the company’s stock worth $453,000 after buying an additional 1,740 shares during the period. DGS Capital Management LLC boosted its position in shares of Dr. Reddy’s Laboratories by 15.2% during the first quarter. DGS Capital Management LLC now owns 9,922 shares of the company’s stock worth $728,000 after buying an additional 1,306 shares during the period. Ballentine Partners LLC boosted its position in shares of Dr. Reddy’s Laboratories by 24.9% during the first quarter. Ballentine Partners LLC now owns 13,391 shares of the company’s stock worth $982,000 after buying an additional 2,666 shares during the period. Finally, Contravisory Investment Management Inc. purchased a new position in shares of Dr. Reddy’s Laboratories during the first quarter worth $189,000. 14.02% of the stock is currently owned by hedge funds and other institutional investors.

Dr. Reddy’s Laboratories Company Profile

Dr. Reddy’s Laboratories Limited, together with its subsidiaries, operates as an integrated pharmaceutical company worldwide. It operates through Global Generics, Pharmaceutical Services and Active Ingredients (PSAI), and Others segments. The company’s Global Generics segment manufactures and markets prescription and over-the-counter finished pharmaceutical products that are marketed under a brand name or as a generic finished dosages with therapeutic equivalence to branded formulations.

Recommended Stories

Receive News & Ratings for Dr. Reddy’s Laboratories Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Dr. Reddy’s Laboratories and related companies with MarketBeat.com’s FREE daily email newsletter.