Zacks Research Brokers Decrease Earnings Estimates for Essex Property Trust, Inc. (NYSE:ESS)

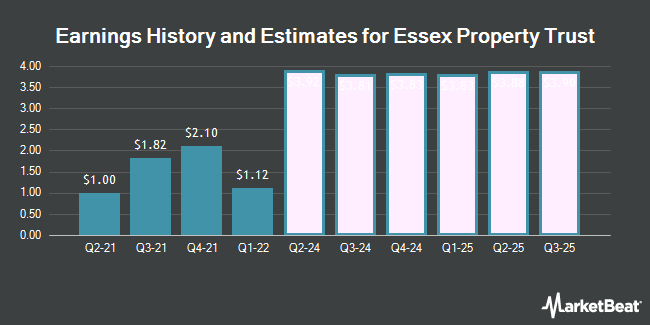

Essex Property Trust, Inc. (NYSE:ESS – Free Report) – Research analysts at Zacks Research lowered their FY2026 earnings per share (EPS) estimates for shares of Essex Property Trust in a note issued to investors on Monday, April 15th. Zacks Research analyst R. Department now forecasts that the real estate investment trust will post earnings per share of $16.12 for the year, down from their prior forecast of $16.34. The consensus estimate for Essex Property Trust’s current full-year earnings is $15.11 per share.

ESS has been the topic of several other reports. Bank of America raised shares of Essex Property Trust from a “neutral” rating to a “buy” rating and upped their price target for the company from $250.00 to $275.00 in a report on Monday, April 1st. StockNews.com cut shares of Essex Property Trust from a “hold” rating to a “sell” rating in a research report on Saturday. Piper Sandler reissued an “overweight” rating and issued a $291.00 price objective on shares of Essex Property Trust in a report on Tuesday, March 26th. The Goldman Sachs Group reaffirmed a “sell” rating and set a $227.00 target price on shares of Essex Property Trust in a report on Thursday, February 22nd. Finally, Mizuho upgraded Essex Property Trust from a “neutral” rating to a “buy” rating and lowered their price target for the company from $255.00 to $250.00 in a report on Wednesday, February 28th. Four equities research analysts have rated the stock with a sell rating, nine have assigned a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of “Hold” and a consensus price target of $245.37.

View Our Latest Stock Analysis on Essex Property Trust

Essex Property Trust Stock Performance

Shares of ESS opened at $232.63 on Tuesday. The firm has a market cap of $14.94 billion, a price-to-earnings ratio of 36.87, a PEG ratio of 3.53 and a beta of 0.80. The company has a quick ratio of 3.26, a current ratio of 3.26 and a debt-to-equity ratio of 1.11. The business’s 50 day moving average is $237.12 and its two-hundred day moving average is $230.47. Essex Property Trust has a 52-week low of $203.85 and a 52-week high of $252.85.

Essex Property Trust Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, April 12th. Investors of record on Friday, March 29th were issued a $2.45 dividend. This represents a $9.80 dividend on an annualized basis and a dividend yield of 4.21%. The ex-dividend date was Wednesday, March 27th. This is a boost from Essex Property Trust’s previous quarterly dividend of $2.31. Essex Property Trust’s dividend payout ratio (DPR) is 155.31%.

Institutional Investors Weigh In On Essex Property Trust

Large investors have recently made changes to their positions in the company. Steward Partners Investment Advisory LLC grew its holdings in Essex Property Trust by 100.0% in the 4th quarter. Steward Partners Investment Advisory LLC now owns 120 shares of the real estate investment trust’s stock worth $25,000 after buying an additional 60 shares in the last quarter. Clear Street Markets LLC bought a new stake in shares of Essex Property Trust during the fourth quarter valued at about $25,000. Lindbrook Capital LLC grew its position in Essex Property Trust by 111.5% in the 4th quarter. Lindbrook Capital LLC now owns 110 shares of the real estate investment trust’s stock valued at $27,000 after buying an additional 58 shares in the last quarter. Pacific Center for Financial Services bought a new position in Essex Property Trust in the 1st quarter valued at about $30,000. Finally, Advisory Services Network LLC acquired a new position in Essex Property Trust during the 1st quarter valued at about $32,000. Institutional investors and hedge funds own 96.51% of the company’s stock.

Essex Property Trust Company Profile

Essex Property Trust, Inc, an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets. Essex currently has ownership interests in 252 apartment communities comprising approximately 62,000 apartment homes with an additional property in active development.

Read More

Receive News & Ratings for Essex Property Trust Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Essex Property Trust and related companies with MarketBeat.com’s FREE daily email newsletter.