Zacks Research Brokers Lift Earnings Estimates for Teva Pharmaceutical Industries Limited (NYSE:TEVA)

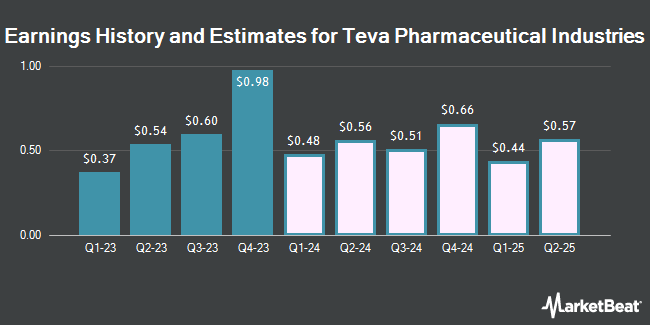

Teva Pharmaceutical Industries Limited (NYSE:TEVA – Free Report) – Research analysts at Zacks Research lifted their Q3 2025 earnings per share (EPS) estimates for Teva Pharmaceutical Industries in a report issued on Wednesday, May 1st. Zacks Research analyst R. Department now anticipates that the company will post earnings per share of $0.62 for the quarter, up from their previous forecast of $0.61. The consensus estimate for Teva Pharmaceutical Industries’ current full-year earnings is $2.28 per share. Zacks Research also issued estimates for Teva Pharmaceutical Industries’ Q4 2025 earnings at $0.78 EPS and FY2025 earnings at $2.42 EPS.

TEVA has been the subject of a number of other research reports. StockNews.com upgraded shares of Teva Pharmaceutical Industries from a “buy” rating to a “strong-buy” rating in a report on Thursday, February 1st. Jefferies Financial Group raised Teva Pharmaceutical Industries from a “hold” rating to a “buy” rating and upped their price objective for the stock from $10.00 to $14.00 in a research report on Tuesday, January 23rd. JPMorgan Chase & Co. upgraded Teva Pharmaceutical Industries from an “underweight” rating to a “neutral” rating and set a $14.00 target price for the company in a report on Friday, March 8th. Barclays upped their price target on Teva Pharmaceutical Industries from $15.00 to $17.00 and gave the stock an “overweight” rating in a report on Monday, February 5th. Finally, The Goldman Sachs Group lifted their price objective on Teva Pharmaceutical Industries from $10.00 to $11.00 and gave the company a “neutral” rating in a research note on Monday, February 5th. Three investment analysts have rated the stock with a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, Teva Pharmaceutical Industries presently has an average rating of “Moderate Buy” and a consensus target price of $13.78.

View Our Latest Stock Report on Teva Pharmaceutical Industries

Teva Pharmaceutical Industries Stock Down 0.7 %

Shares of NYSE:TEVA opened at $13.98 on Friday. The firm has a market capitalization of $15.67 billion, a PE ratio of -29.74, a price-to-earnings-growth ratio of 1.67 and a beta of 1.04. Teva Pharmaceutical Industries has a 1 year low of $7.09 and a 1 year high of $14.47. The company has a debt-to-equity ratio of 2.23, a current ratio of 1.02 and a quick ratio of 0.69. The firm’s 50-day moving average is $13.61 and its two-hundred day moving average is $11.57.

Teva Pharmaceutical Industries (NYSE:TEVA – Get Free Report) last posted its earnings results on Wednesday, January 31st. The company reported $0.98 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.73 by $0.25. The firm had revenue of $4.46 billion for the quarter, compared to analyst estimates of $3.97 billion. Teva Pharmaceutical Industries had a positive return on equity of 34.90% and a negative net margin of 3.33%.

Insider Activity at Teva Pharmaceutical Industries

In other Teva Pharmaceutical Industries news, CEO Richard D. Francis sold 74,530 shares of the firm’s stock in a transaction that occurred on Thursday, February 15th. The shares were sold at an average price of $13.15, for a total transaction of $980,069.50. Following the sale, the chief executive officer now owns 87,125 shares of the company’s stock, valued at $1,145,693.75. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. In related news, EVP Mark Sabag sold 100,000 shares of the company’s stock in a transaction dated Tuesday, March 5th. The stock was sold at an average price of $13.52, for a total value of $1,352,000.00. Following the completion of the sale, the executive vice president now directly owns 382,590 shares of the company’s stock, valued at approximately $5,172,616.80. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, CEO Richard D. Francis sold 74,530 shares of the firm’s stock in a transaction that occurred on Thursday, February 15th. The stock was sold at an average price of $13.15, for a total value of $980,069.50. Following the transaction, the chief executive officer now owns 87,125 shares in the company, valued at approximately $1,145,693.75. The disclosure for this sale can be found here. Insiders sold 358,972 shares of company stock valued at $4,739,820 over the last three months. 0.55% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Teva Pharmaceutical Industries

Large investors have recently modified their holdings of the company. Commonwealth Equity Services LLC boosted its stake in Teva Pharmaceutical Industries by 5.2% during the 3rd quarter. Commonwealth Equity Services LLC now owns 255,477 shares of the company’s stock worth $2,606,000 after purchasing an additional 12,587 shares during the period. Fjarde AP Fonden Fourth Swedish National Pension Fund grew its holdings in shares of Teva Pharmaceutical Industries by 5.6% during the third quarter. Fjarde AP Fonden Fourth Swedish National Pension Fund now owns 351,170 shares of the company’s stock worth $3,582,000 after buying an additional 18,519 shares during the last quarter. Bank of New York Mellon Corp increased its position in Teva Pharmaceutical Industries by 1.1% in the 3rd quarter. Bank of New York Mellon Corp now owns 1,902,235 shares of the company’s stock valued at $19,403,000 after acquiring an additional 19,906 shares during the period. Migdal Insurance & Financial Holdings Ltd. raised its stake in Teva Pharmaceutical Industries by 14.4% during the 3rd quarter. Migdal Insurance & Financial Holdings Ltd. now owns 27,059,540 shares of the company’s stock valued at $276,000,000 after acquiring an additional 3,413,100 shares during the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its position in Teva Pharmaceutical Industries by 9.2% during the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 412,277 shares of the company’s stock worth $4,205,000 after acquiring an additional 34,623 shares during the period. 54.05% of the stock is owned by institutional investors and hedge funds.

Teva Pharmaceutical Industries Company Profile

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes generic medicines, specialty medicines, and biopharmaceutical products in North America, Europe, Israel, and internationally. It offers generic medicines in various dosage forms, such as tablets, capsules, injectables, inhalants, liquids, transdermal patches, ointments, and creams; sterile products, hormones, high-potency drugs, and cytotoxic substances in parenteral and solid dosage forms; and generic products with medical devices and combination products.

Further Reading

Receive News & Ratings for Teva Pharmaceutical Industries Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Teva Pharmaceutical Industries and related companies with MarketBeat.com’s FREE daily email newsletter.