McKinsey’s Roland Rechtsteiner on the energy transition and commodities markets

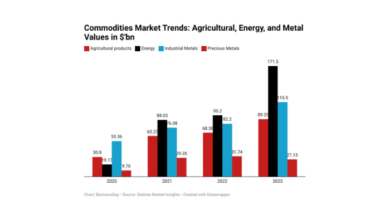

Commodities markets have seen rapid growth over recent years, attracting new players and creating new opportunities for a transitioning energy sector in need of investment.

It is “a positive development”, according to a new report by strategy and management consultancy McKinsey, which suggests that vibrant markets are good news for value pools, as well as developing transitional technologies.

McKinsey partner Roland Rechtsteiner leads the company’s commodity risk and trading work. He spoke to Energy Monitor to explain the implications of the increasing interconnectedness of the commodities and energy markets, as well as the significance of the increasing volatility.

Eve Thomas (ET): The report notes that the commodities market has experienced “rapid growth”. Why is this?

Roland Reichtsteiner (RR): There are multiple key drivers for the growth we have seen over the past years. There are short-term events: Covid, the supply chain crisis and the Russian invasion of Ukraine. These drive a lot of volatility, but the larger underlying volatility driver is the energy transition.

The energy transition across all commodities is having two key impacts. Firstly, it’s connecting all the different asset classes to each other, and the players within these asset classes. Secondly, it’s constantly changing supply and demand balances across commodities, which is also driving volatility. The higher the volatility, the more that is required in terms of global trade and balancing, and that’s ultimately what drives the commodity trading value pools.

The predominant factor is the energy transition. The resulting shifts in supply and demand means that volatility is here to stay. Whilst we can already see some of the extreme volatility stabilising, we certainly see that volatility driven by the energy transition is here to stay. We anticipate a ‘new normal’, which will be somewhere lower than what we have seen over the past two years but considerably higher than what we’ve seen in the last decade.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

ET: What is driving the ‘new normal’?

RR: We are seeing that due to the increased volatility and increased value pool, every organisation that is either producing or buying large amounts of commodities is thinking about how they can establish their commercial or trading activities. Existing traders are looking at increasing their sophistication to capture greater market share. If they are not yet trading, they are exploring entry strategies to participate in that market.

So how can they build up these capabilities? Why is it important? It’s not only about getting access to the margin. It is also important because it helps in terms of price discovery, and in terms of understanding customer or supplier requirements, as well as on the risk management side. We anticipate more players entering the market on the back of their physical flows, and we will see more volumes coming into traded markets as opposed to pure marketing.

ET: How will investment in the commodities market help to facilitate the energy transition?

RR: Firstly, there has been significant investment in renewable power generation in the past and it has continued. It started out in Europe and now it’s gaining momentum heavily in North America as well. It’s also happening in Asia, specifically in China but also in Japan, Korea and Australia. On the production side, the generation of renewable power is developing rapidly, whilst demand has also grown rapidly because of the transition from hydrocarbons to power usage.

The second point that is creating imbalance is that power is not necessarily generated where it is actually required. For instance, when it comes to wind power, in Europe it is primarily produced in the north, but a lot of the power is actually required on the continent. It requires a lot of transmission infrastructure investments, which will likely dominate investments going forward. On top of that, in order to balance all of these markets, you need storage, flexibility and balance capacity as well.

ET: The report also notes that commodity markets are “more interconnected” with energy markets. What will be the impact of this?

RR: There are several impacts of an increasingly interconnected energy market that are quite interesting. We stated in the report that you have increasing correlation between energy markets; whilst on the one side we’re seeing some bifurcation in global energy markets, specifically around oil and gas, on the other side we’re seeing increasing correlation.

For instance, look at power and LNG [liquefied natural gas]. You have much more global connectivity of gas markets and because gas markets are still significantly driving power prices, you have connectivity of power markets through that. At the same time, in the metals markets, you have a much stronger link now to power as well through the use of electric furnaces or renewable power or green hydrogen in refineries. With biofuels, you have strong connectivity between more liquid markets, which were historically the hydrocarbon markets and the agricultural markets. You see increasing connectivity on a global basis, which is just going to increase.

ET: How can traders capture value by supporting the energy transition?

RR: There are two things to say here. First, how traders can create value or benefit from the energy transition. Second, how the activities of traders are benefitting the energy transition, because it is circular.

On the first point, you have many new asset classes coming into traded markets, whether these are energy transition metals such as lithium and cobalt, or in the power markets, whether it’s LNG, hydrogen or ammonia, say.

This all creates the need for prompt inventory for global logistic chains and the trading supporting that. Physical commodity traders specialise in this aspect. Understanding price signals around the world and bringing the commodities to where they are required is how traders can capitalise on that volatility.

At the same time, traders have an interest in liquid markets because that’s what they need to risk manage their exposures. They are pushing hard to get more liquid markets. Through that drive, they have the ability to connect producers and consumers and also to offer risk management products in between to manage participation models in these value chains. As the energy transition is developing, more of that is required and the traders bring the capabilities as well as the analytical horsepower to support that transition – and to be a catalyst.