Asia Stocks Set to Fall as Meta Drags on Big Tech: Markets Wrap

(Bloomberg) — Asian equity markets were poised to open lower after Meta Platforms Inc.’s disappointing outlook raised concern on whether the industry that has powered the bull market in equities has run too far.

Most Read from Bloomberg

Futures for benchmarks in Tokyo and Hong Kong declined, while US stock contracts sank in early Asian trading. Australian financial markets are shut for a holiday. The yen was little changed after weakening beyond 155 per dollar for the first time in more than three decades on Wednesday.

A $250 billion exchange-traded fund tracking the Nasdaq 100 got hit after the close of regular trading as the Facebook parent tumbled more than 15%. Meta projected second-quarter sales that were below analyst expectations and increased its spending estimates for the year.

Read more: Meta Sinks on Revenue Guide and Spending Plans: Street Wrap

“Meta’s resources are vast, but not infinite,” said Sophie Lund-Yates, an analyst at Hargreaves Lansdown Plc. “The language around spending plans has become bolder once more, and this could be what’s spooking markets.”

In the run-up to the results, the S&P 500 struggled to gain traction, hovering near 5,070 as traders positioned for economic data that will help shape the views on the Federal Reserve’s next steps. Treasury 10-year yields rose four basis points to 4.64%.

The Facebook parent reported revenue of $36.5 billion in the first quarter, an increase of more than 27% over the same period a year ago. It was a small beat, as analysts were looking for revenue of $36.1 billion on average, according to estimates compiled by Bloomberg. Profit more than doubled to $12.4 billion.

“We encourage investors to focus on the positives,” said Tejas Dessai at Global X ETFs. “The company’s fundamentals continue to show strength, and that’s the key story.”

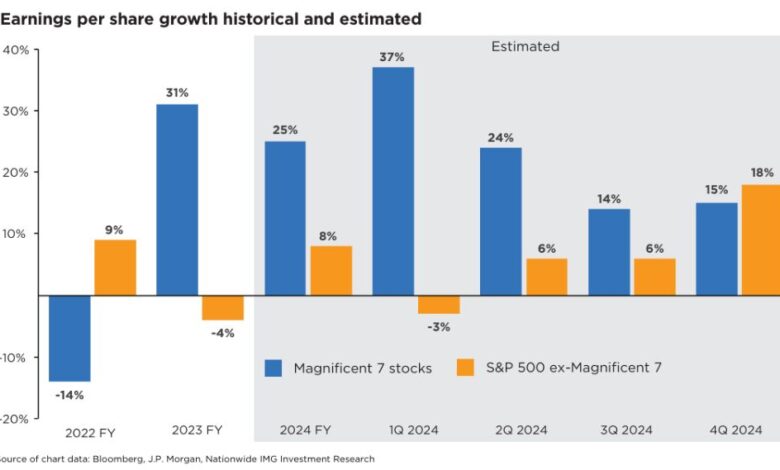

To Mark Hackett at Nationwide, while the cohort of seven tech megacaps has done well in the last two years because of their superior earnings growth relative to the broader market, this advantage could decrease in 2024 and even more significantly in 2025.

“The ‘Magnificent Seven’ are not nearly as powerful as they once were,” Hackett said. “We see this as a positive development for investors looking to diversify away from the recent market leaders.”

Meantime, a JPMorgan Chase & Co. indicator is flashing a resounding buy signal in US stocks, after it hit a threshold that typically precedes better-than-average gains.

The bank’s US Tactical Positioning Monitor hit a level that reflects an “attractive set-up” for the S&P 500, according to a team led by Andrew Tyler, JPMorgan’s head of US market intelligence.

The stock gauge has historically gained around 3% in the subsequent 20 days after a similar four-week change in positioning, compared to a roughly 1% gain in all periods, according to the note.

For weeks, traders have been scaling back how many rate cuts they expect from the Fed amid a string of resilient economic data. Economists surveyed by Bloomberg predict gross domestic product likely cooled to around 2.5% in the first quarter, with the figures still potentially suggesting persistent inflationary pressures.

“Tomorrow’s pivotal GDP report comes as market participants hope for a soft number that would lead to rate cuts sooner rather than later,” said Jose Torres at Interactive Brokers. “We expect a stronger-than-projected figure. It would be great for revenue growth prospects, but bad for the timing and extent of rate cuts.”

Corporate Highlights:

-

International Business Machines Corp. posted earnings that disappointed investors as the company’s consulting unit continues to see weak demand. It also announced the acquisition of software firm HashiCorp Inc.

-

Ford Motor Co., rapidly retooling its electric vehicle strategy in a decelerating market for plug-ins, posted first-quarter results that beat expectations on strong sales of work trucks.

-

Chipotle Mexican Grill Inc. raised its full-year outlook as limited-time offers such as chicken al pastor helped boost demand, continuing a streak of positive results as other chains struggle to boost diner traffic.

-

Boeing Co. Chief Executive Officer Dave Calhoun said the embattled planemaker is making progress toward turning around its manufacturing and that it will hit its mid-decade cash-flow goal, even after reporting a major outflow in the first three months of the year it slows output.

-

BHP Group Ltd. is considering a potential takeover of Anglo American Plc, people with knowledge of the matter said, in what would rank as one of the year’s biggest deals.

-

Amazon.com Inc. and Microsoft Corp.’s investments into artificial intelligence startups will get deeper scrutiny from the UK’s antitrust watchdog.

Key events this week:

-

US GDP, wholesale inventories, initial jobless claims, Thursday

-

Microsoft, Alphabet, Airbus earnings, Thursday

-

Japan rate decision, Tokyo CPI, inflation and GDP forecasts, Friday

-

US personal income and spending, PCE deflator, University of Michigan consumer sentiment, Friday

-

Exxon Mobil, Chevron earnings, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.6% as of 8:17 a.m. Tokyo time. The S&P 500 was little changed

-

Nasdaq 100 futures fell 1.1%. The Nasdaq 100 rose 0.3%

-

Hang Seng futures fell 0.4%

-

Nikkei 225 futures fell 1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0697

-

The yen was little changed at 155.25 per dollar

-

The offshore yuan was little changed at 7.2734 per dollar

Cryptocurrencies

-

Bitcoin rose 0.3% to $64,223.87

-

Ether was little changed at $3,127.99

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rita Nazareth.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.