Investors’ wealth erodes by Rs 2.91 lakh crore as markets tumble – Market News

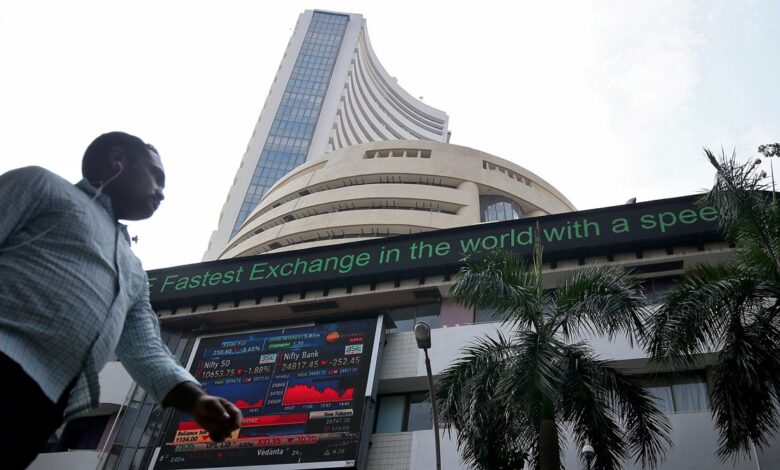

Investors became poorer by Rs 2.91 lakh crore on Monday as the BSE benchmark Sensex fell sharply by nearly 1 per cent amid a weak trend in global markets. The 30-share BSE Sensex plunged 670.93 points or 0.93 per cent to settle at 71,355.22. During the day, it tumbled 725.11 points or 1 per cent to 71,301.04.

The market capitalisation of BSE

While rising valuations were beginning to raise concerns, investors resorted to profit-taking as weakness in banking, IT and oil & gas stocks saw the Sensex end below the 72,000 mark,” Prashanth Tapse, Senior VP (Research) at Mehta Equities Ltd, said.

In Asian markets, Seoul, Shanghai and Hong Kong settled lower. Japan’s Nikkei was closed for a holiday. European markets were trading lower. The US markets ended marginally up on Friday.

Among the Sensex firms, State Bank of India

In contrast, HCL Technologies, NTPC, Sun Pharma, Power Grid, Bajaj Finance

Among the indices, FMCG fell 1.55 per cent, commodities declined 1.44 per cent, bankex (1.42 per cent), metal (1.40 per cent), financial services (1.05 per cent), telecommunication (0.93 per cent), IT (0.90 per cent) and teck (0.77 per cent).

Power, realty and services were the gainers. “Global stocks slipped on Monday ahead of a busy week of inflation and economic data and amid the diminishing prospect of a cut in US interest rates in the first quarter. Stocks fell ahead of a corporate reporting season where robust results are needed to justify high valuations,” Deepak Jasani, Head of Retail Research at HDFC Securities, said.