Key Global Events To Watch & Potential Impact

As the crypto market braces for a week of significant global economic events, investors are on high alert, particularly in the wake of recent inflation data surprises. With pivotal announcements scheduled across major economies, these events are poised to shape the trajectory of both traditional and digital financial markets.

So, let’s take a closer look at the key events this week.

Crypto Market: Events To Watch This Week

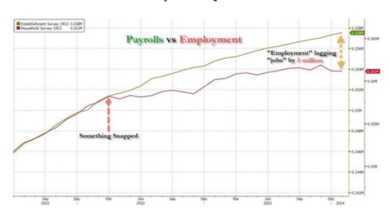

U.S. Economic Data & Federal Reserve Developments

The release of U.S. Retail Sales Data on April 15 sets the stage for market sentiment, offering crucial insights into the health of the world’s largest economy. Notably, the crypto market enthusiasts, as well as the global financial market enthusiasts, keenly anticipate cues on future Federal Reserve actions, especially after hotter-than-expected inflation figures last week.

On the other hand, Fed Chair Jerome Powell’s speech, scheduled for April 16, further fuels speculation, as the crypto market participants seek clarity on potential policy rate adjustments amid evolving economic conditions. In addition, Fed Governor Michelle Bowman’s remarks on April 17 provide additional context, as markets scrutinize signals of U.S. economic health and potential policy adjustments by the Federal Reserve.

Notably, last week’s U.S. Consumer Price Index (CPI) data revealed a 3.5% increase in inflation for March, slightly surpassing market forecasts of 3.4% and up from the previous rate of 3.2%. Conversely, the U.S. Producer Price Index (PPI) saw a 2.1% rise in March, marking a significant uptick from February’s 1.6% inflation rate.

These figures indicate ongoing inflationary pressures within the U.S. economy, potentially influencing monetary policy decisions in the coming months and raising speculations in the crypto market.

Canada, China, & Eurozone Economic Indicators and Market Sentiment

The focus then shifts to Canada’s CPI Inflation Data, also on April 16, presenting a global perspective on inflation trends. On the other hand, China’s GDP data release on the same day offers insights into the performance of the world’s second-largest economy, influencing global crypto market investors’ sentiment.

In addition, on April 17, attention also turns to the Eurozone as Euro CPI inflation data is unveiled. Following the surprise in U.S. inflation data, the crypto market will closely monitor these indicators for potential implications on global financial markets.

Meanwhile, amid heightened volatility, the crypto market participants seek cues on inflationary pressures and policy responses, shaping investment strategies across traditional and cryptocurrency assets.

What’s Next For Crypto Market?

The week’s lineup of economic events underscores the interconnectedness of the global financial sphere and the crypto market. As investors navigate evolving economic landscapes, these key data releases and speeches serve as pivotal moments, influencing market sentiment and driving price movements.

In addition, the Bitcoin Halving is scheduled for next week, which might impact the BTC price momentum in the coming days. Notably, the investors are eagerly waiting for the event, considering the surge in BTC price after the previous Halving events.

Meanwhile, with eyes on central bank actions and economic indicators, the crypto market braces for potential shifts, highlighting the intricate relationship between macroeconomic developments and digital asset valuations.