Brookstone Capital Management Acquires New Stake in Wheaton Precious Metals Corp. (NYSE:WPM)

Brookstone Capital Management purchased a new position in Wheaton Precious Metals Corp. (NYSE:WPM – Free Report) during the 4th quarter, HoldingsChannel.com reports. The firm purchased 4,531 shares of the company’s stock, valued at approximately $224,000.

Brookstone Capital Management purchased a new position in Wheaton Precious Metals Corp. (NYSE:WPM – Free Report) during the 4th quarter, HoldingsChannel.com reports. The firm purchased 4,531 shares of the company’s stock, valued at approximately $224,000.

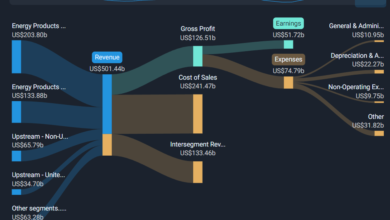

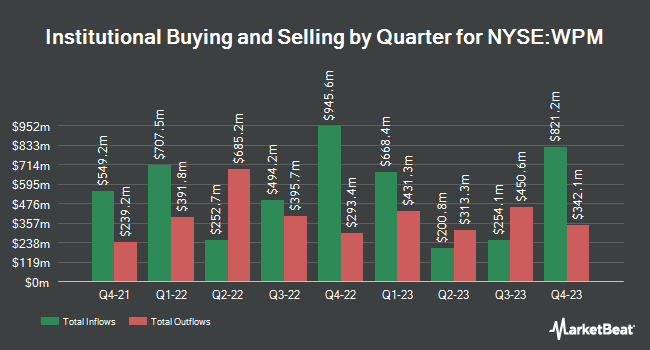

Other hedge funds have also recently added to or reduced their stakes in the company. Sprott Inc. grew its position in Wheaton Precious Metals by 4.8% in the third quarter. Sprott Inc. now owns 799,533 shares of the company’s stock worth $32,421,000 after buying an additional 36,654 shares during the last quarter. Deutsche Bank AG grew its position in Wheaton Precious Metals by 4.4% in the third quarter. Deutsche Bank AG now owns 3,623,133 shares of the company’s stock worth $146,918,000 after buying an additional 152,826 shares during the last quarter. Douglas Lane & Associates LLC grew its position in Wheaton Precious Metals by 186.9% in the third quarter. Douglas Lane & Associates LLC now owns 310,914 shares of the company’s stock worth $12,608,000 after buying an additional 202,539 shares during the last quarter. Vanguard Group Inc. grew its position in Wheaton Precious Metals by 1.6% in the third quarter. Vanguard Group Inc. now owns 16,203,069 shares of the company’s stock worth $657,034,000 after buying an additional 248,541 shares during the last quarter. Finally, Mackenzie Financial Corp grew its position in Wheaton Precious Metals by 18.3% in the third quarter. Mackenzie Financial Corp now owns 3,411,151 shares of the company’s stock worth $133,849,000 after buying an additional 527,358 shares during the last quarter. Institutional investors and hedge funds own 70.34% of the company’s stock.

Wall Street Analysts Forecast Growth

Several research analysts have issued reports on WPM shares. National Bank Financial lowered shares of Wheaton Precious Metals from an “outperform” rating to a “sector perform” rating in a research report on Wednesday, February 21st. Jefferies Financial Group initiated coverage on shares of Wheaton Precious Metals in a research note on Thursday, February 29th. They issued a “buy” rating and a $49.00 price objective for the company. Raymond James decreased their price objective on shares of Wheaton Precious Metals from $60.00 to $58.00 and set a “market perform” rating for the company in a research note on Thursday, February 22nd. Scotiabank decreased their price objective on shares of Wheaton Precious Metals from $60.00 to $59.00 and set a “sector outperform” rating for the company in a research note on Wednesday, February 28th. Finally, TD Securities raised shares of Wheaton Precious Metals from a “hold” rating to a “buy” rating and raised their price objective for the stock from $51.00 to $53.00 in a research note on Monday, March 18th. Six equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat.com, the company currently has an average rating of “Moderate Buy” and a consensus target price of $60.81.

View Our Latest Stock Report on WPM

Wheaton Precious Metals Stock Up 3.7 %

Shares of NYSE:WPM opened at $46.29 on Thursday. The firm has a fifty day moving average of $44.54 and a two-hundred day moving average of $45.03. The firm has a market capitalization of $20.97 billion, a P/E ratio of 38.90, a price-to-earnings-growth ratio of 11.66 and a beta of 0.76. Wheaton Precious Metals Corp. has a 12-month low of $38.37 and a 12-month high of $52.76.

Wheaton Precious Metals Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, April 15th. Shareholders of record on Wednesday, April 3rd will be paid a dividend of $0.155 per share. The ex-dividend date is Tuesday, April 2nd. This represents a $0.62 dividend on an annualized basis and a dividend yield of 1.34%. This is a positive change from Wheaton Precious Metals’s previous quarterly dividend of $0.15. Wheaton Precious Metals’s dividend payout ratio (DPR) is 50.42%.

Wheaton Precious Metals Profile

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 10, 2017. Wheaton Precious Metals Corp.

See Also

Want to see what other hedge funds are holding WPM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Wheaton Precious Metals Corp. (NYSE:WPM – Free Report).

Receive News & Ratings for Wheaton Precious Metals Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Wheaton Precious Metals and related companies with MarketBeat.com’s FREE daily email newsletter.