Fmr LLC Has $36.43 Million Stock Position in Triple Flag Precious Metals Corp. (NYSE:TFPM)

Fmr LLC cut its holdings in shares of Triple Flag Precious Metals Corp. (NYSE:TFPM – Free Report) by 27.9% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 2,781,116 shares of the company’s stock after selling 1,078,400 shares during the period. Fmr LLC owned 1.38% of Triple Flag Precious Metals worth $36,426,000 as of its most recent filing with the Securities and Exchange Commission.

Fmr LLC cut its holdings in shares of Triple Flag Precious Metals Corp. (NYSE:TFPM – Free Report) by 27.9% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 2,781,116 shares of the company’s stock after selling 1,078,400 shares during the period. Fmr LLC owned 1.38% of Triple Flag Precious Metals worth $36,426,000 as of its most recent filing with the Securities and Exchange Commission.

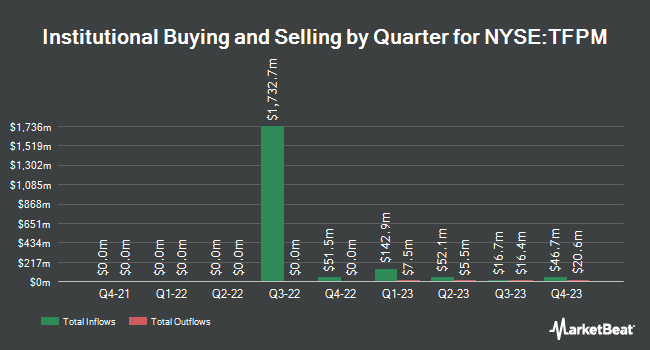

Several other hedge funds also recently modified their holdings of TFPM. Tocqueville Asset Management L.P. acquired a new stake in shares of Triple Flag Precious Metals during the third quarter worth $134,000. Citigroup Inc. acquired a new stake in shares of Triple Flag Precious Metals in the 3rd quarter valued at approximately $549,000. HighTower Advisors LLC boosted its stake in Triple Flag Precious Metals by 50.4% during the 3rd quarter. HighTower Advisors LLC now owns 21,123 shares of the company’s stock worth $277,000 after acquiring an additional 7,079 shares during the last quarter. Montrusco Bolton Investments Inc. acquired a new position in Triple Flag Precious Metals during the third quarter valued at approximately $7,219,000. Finally, Barclays PLC increased its stake in Triple Flag Precious Metals by 0.7% in the third quarter. Barclays PLC now owns 123,003 shares of the company’s stock valued at $1,608,000 after purchasing an additional 907 shares in the last quarter. Institutional investors own 80.91% of the company’s stock.

Analysts Set New Price Targets

TFPM has been the topic of a number of recent analyst reports. TheStreet raised shares of Triple Flag Precious Metals from a “d+” rating to a “c-” rating in a research report on Wednesday, December 27th. Jefferies Financial Group started coverage on Triple Flag Precious Metals in a research note on Thursday. They issued a “buy” rating and a $14.00 target price for the company. Four equities research analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock presently has an average rating of “Buy” and a consensus target price of $22.70.

View Our Latest Stock Report on Triple Flag Precious Metals

Triple Flag Precious Metals Trading Up 3.4 %

TFPM opened at $12.93 on Friday. The stock has a market capitalization of $2.60 billion, a P/E ratio of 68.06, a P/E/G ratio of 2.50 and a beta of -0.05. The company has a current ratio of 3.29, a quick ratio of 3.21 and a debt-to-equity ratio of 0.03. Triple Flag Precious Metals Corp. has a 12 month low of $11.75 and a 12 month high of $17.33. The firm’s fifty day simple moving average is $12.68 and its 200 day simple moving average is $12.99.

Triple Flag Precious Metals Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, March 15th. Stockholders of record on Monday, March 4th will be given a dividend of $0.052 per share. The ex-dividend date of this dividend is Friday, March 1st. This represents a $0.21 annualized dividend and a dividend yield of 1.61%. Triple Flag Precious Metals’s dividend payout ratio is currently 110.53%.

Triple Flag Precious Metals Company Profile

Triple Flag Precious Metals Corp., a gold-focused streaming and royalty company, engages in acquiring and managing precious metals and other streams and royalties in Australia, Canada, Colombia, Mongolia, Peru, South Africa, and the United States. The company has a portfolio of streams and royalties providing exposure primarily to gold and silver.

See Also

Want to see what other hedge funds are holding TFPM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Triple Flag Precious Metals Corp. (NYSE:TFPM – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Triple Flag Precious Metals, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Triple Flag Precious Metals wasn’t on the list.

While Triple Flag Precious Metals currently has a “Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.