Alternative Investing in 2024: Trends and Predictions | Personal Finance

Alternative investment assets under management added up to $13.7 trillion in 2021. Investment fund analysts Prequin projects them to nearly double that in the next few years – $23.3 trillion by 2027.

The ultrarich earmark at least 50% of their assets for alternative investment. They’re not the only ones.

More and more average people consider various alternative investments, be it hedge funds, private equity, or even collectible fandom merchandise.

What Is Alternative Investing

Traditional forms of investment — bonds, stocks, and cash — differ from alternative investments. These investments are usually not liquid and cannot easily convert into cash. Tangible alternative investments include real estate and precious metals. Other assets include hedge funds, distressed securities, and private equity.

The United States Securities and Exchange Commission (SEC) does not regulate this type of investment. Earlier, only institutional and ultrarich investors could access alternative investments. However, this is no longer the case. Individual and retail investors incorporate these assets into their portfolios to maximize profits and reduce risk.

One thing that sets alternative investments apart is their low correlation with traditional assets, meaning elements influencing conventional asset prices don’t have quite the same effect on alternative investments. Also, the process of determining their value is more complicated. Specific knowledge is necessary to determine the value of assets like fine art, where the demand patterns may be unpredictable, shifting according to the latest market trends.

Alternative investments cannot easily convert into cash due to their relatively low demand and a lack of centralized markets. Compared to traditional instruments, the buying prices are high, and some assets require investors to invest a minimum amount.

The State and Kinds of Alternative Investing

Private Equity

Private equity has a long history of generating decent returns and outperforming public markets during economic booms and depressions. However, profound interest rate changes during the pandemic pose serious investor challenges. Due to rising interest rates, private equity managers must deal with a higher leverage cost.

Investors should exercise caution while accessing long-term investments like fintech, security, health care, and AI and their embedded leverage. They should minimize leverage use and focus efforts on trustworthy, steadily growing companies to avoid relying on financing, which is often sensitive to interest rate fluctuations.

Private Credit

Several banks now follow tighter lending standards and reduce balance sheet exposure after the 2023 regional financial crisis. Consequently, new firms face difficulties when securing loans. Financial institutions have cut down on lending. Debt issuance in the public market is not very high, although it’s showing signs of improvement.

The current market provides more opportunities for private credit managers to offer capital. Thanks to increased base rates, investors are enjoying higher profits. Private credit may be a more secure option than other fixed-income sources.

Real Estate

Recent headlines regarding office foreclosures and vacancies perpetuate the belief that office properties are not faring well despite real estate fundamentals remaining relatively stable across multiple sectors. There are a few indications of oversupply despite property values going down.

This year, near-term debt maturities may cause market distress. However, there are reasonably priced opportunities to invest in properties like data centers, life science offices, and single-family homes.

Hedge Funds

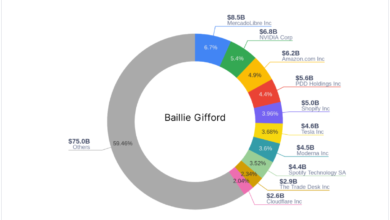

Hedge Funds are a great option if you want active returns on investment. However, they are only suitable for institutional investors and the extremely wealthy, who are not subject to strict regulatory oversight by The U.S. Securities and Exchange Commission. Hedge fund managers often use risky investments to maximize returns and require investors to make high minimum investments.

Current Trends

Democratization

Democratization has had a profound impact on the alternative investment market. Investors now have more access to opportunities than ever. Several individuals are using crowdfunding, for example, to start with alternative investing. Meanwhile, both investors and organizations are opting for private lending opportunities.

Investors Looking for Unique Opportunities

Last year, housing prices soared, leading to speculations about a market crash in 2024. In 2008, following the housing market crash, several investors took the opportunity to buy houses for cheap. In the event of an economic depression, this trend will repeat itself. Individual investors with cash will see it as an opportunity to diversify their portfolios and rush to take advantage of the situation.

Investors Backing Adaptable Companies

In a shifting technological landscape, companies that are adaptable will fare better than those unwilling to change business conduct methods. Amazon now dominates its sector because it adapted to the e-commerce boom early on. In comparison, Walmart is still playing catch-up.

This divide between adaptable and non-adaptable companies will open up several doors of opportunity for shrewd investors. They can use direct investments, private equity, and hedge funds to back organizations with a proven track record of adaptability to technology changes.