Brokers Issue Forecasts for Mitek Systems, Inc.’s Q2 2024 Earnings (NASDAQ:MITK)

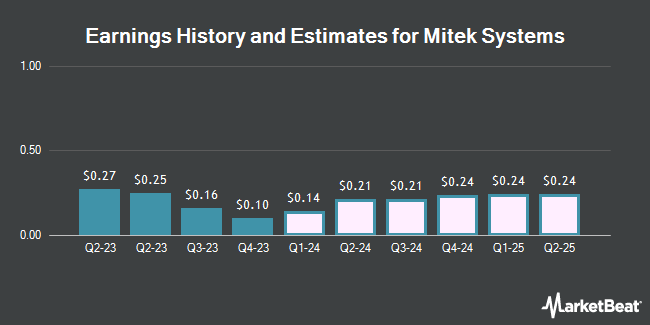

Mitek Systems, Inc. (NASDAQ:MITK – Free Report) – Stock analysts at William Blair lowered their Q2 2024 earnings per share estimates for Mitek Systems in a research note issued to investors on Monday, April 1st. William Blair analyst J. Roberge now expects that the software maker will earn $0.20 per share for the quarter, down from their prior forecast of $0.22. The consensus estimate for Mitek Systems’ current full-year earnings is $0.83 per share.

A number of other equities analysts have also recently commented on the company. StockNews.com cut Mitek Systems from a “buy” rating to a “hold” rating in a report on Thursday, March 21st. HC Wainwright reissued a “buy” rating and set a $19.00 target price on shares of Mitek Systems in a report on Wednesday, March 20th. Finally, Craig Hallum started coverage on Mitek Systems in a research report on Thursday, December 14th. They issued a “buy” rating and a $17.00 price target for the company.

Get Our Latest Stock Analysis on Mitek Systems

Mitek Systems Stock Performance

NASDAQ MITK opened at $13.89 on Wednesday. The stock has a market capitalization of $649.91 million, a price-to-earnings ratio of 86.82 and a beta of 1.09. Mitek Systems has a twelve month low of $8.77 and a twelve month high of $14.56. The company has a current ratio of 3.69, a quick ratio of 3.69 and a debt-to-equity ratio of 0.66. The stock has a 50-day moving average of $12.40 and a 200 day moving average of $11.72.

Mitek Systems (NASDAQ:MITK – Get Free Report) last released its quarterly earnings results on Tuesday, March 19th. The software maker reported $0.10 earnings per share for the quarter. The company had revenue of $37.66 million during the quarter. Mitek Systems had a return on equity of 17.83% and a net margin of 4.25%.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of MITK. Tower Research Capital LLC TRC increased its position in shares of Mitek Systems by 88.5% during the third quarter. Tower Research Capital LLC TRC now owns 3,142 shares of the software maker’s stock worth $29,000 after purchasing an additional 1,475 shares in the last quarter. Point72 Middle East FZE acquired a new stake in shares of Mitek Systems during the fourth quarter worth $40,000. Quarry LP boosted its holdings in Mitek Systems by 536.0% in the first quarter. Quarry LP now owns 4,738 shares of the software maker’s stock valued at $45,000 after acquiring an additional 3,993 shares during the last quarter. Royal Bank of Canada raised its position in Mitek Systems by 66.4% in the third quarter. Royal Bank of Canada now owns 4,954 shares of the software maker’s stock valued at $46,000 after purchasing an additional 1,977 shares during the period. Finally, Covestor Ltd raised its position in Mitek Systems by 32.3% in the third quarter. Covestor Ltd now owns 6,107 shares of the software maker’s stock valued at $65,000 after purchasing an additional 1,492 shares during the period. 83.64% of the stock is currently owned by hedge funds and other institutional investors.

About Mitek Systems

Mitek Systems, Inc provides mobile image capture and digital identity verification solutions worldwide. Its product portfolio includes Mobile Deposit that enables individuals and businesses to remotely deposit checks using their camera-equipped smartphone or tablet; Mobile Verify, an identity verification solution that is integrated into mobile apps, mobile websites, and desktop applications; and Mobile Fill, which includes automatic image capture, minimizes the numbers of clicks, and expedites form fill completion.

Further Reading

Receive News & Ratings for Mitek Systems Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Mitek Systems and related companies with MarketBeat.com’s FREE daily email newsletter.