Brokers Offer Predictions for Enhabit, Inc.’s Q4 2024 Earnings (NYSE:EHAB)

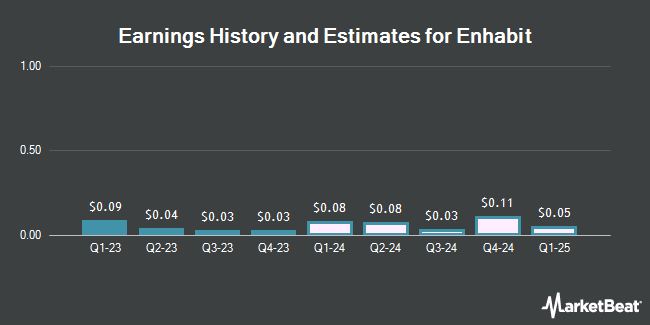

Enhabit, Inc. (NYSE:EHAB – Free Report) – Leerink Partnrs cut their Q4 2024 earnings per share estimates for Enhabit in a report issued on Monday, March 11th. Leerink Partnrs analyst W. Mayo now forecasts that the company will post earnings of $0.05 per share for the quarter, down from their prior forecast of $0.06. The consensus estimate for Enhabit’s current full-year earnings is $0.26 per share. Leerink Partnrs also issued estimates for Enhabit’s Q1 2025 earnings at $0.05 EPS.

Enhabit (NYSE:EHAB – Get Free Report) last released its earnings results on Wednesday, March 6th. The company reported $0.03 EPS for the quarter, beating the consensus estimate of $0.02 by $0.01. Enhabit had a positive return on equity of 1.55% and a negative net margin of 7.69%. The firm had revenue of $260.60 million during the quarter, compared to analyst estimates of $260.30 million. During the same period in the prior year, the firm posted $0.32 earnings per share.

EHAB has been the subject of a number of other research reports. Oppenheimer reissued a “market perform” rating on shares of Enhabit in a research report on Thursday, March 7th. TD Cowen began coverage on Enhabit in a research report on Tuesday, December 12th. They issued a “market perform” rating and a $12.00 target price for the company. Jefferies Financial Group decreased their target price on Enhabit from $15.00 to $14.00 and set a “buy” rating for the company in a research report on Wednesday, March 6th. Finally, UBS Group raised Enhabit from a “sell” rating to a “neutral” rating and set a $9.50 target price for the company in a research report on Thursday, March 7th. Two research analysts have rated the stock with a sell rating, five have assigned a hold rating and one has given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of “Hold” and a consensus target price of $12.50.

Read Our Latest Stock Analysis on EHAB

Enhabit Price Performance

EHAB stock opened at $10.80 on Thursday. The stock has a 50-day moving average price of $9.76 and a two-hundred day moving average price of $10.09. Enhabit has a 12-month low of $7.12 and a 12-month high of $14.59. The company has a current ratio of 1.53, a quick ratio of 1.52 and a debt-to-equity ratio of 0.76. The company has a market cap of $541.40 million, a PE ratio of -6.69, a price-to-earnings-growth ratio of 1.42 and a beta of 1.86.

Institutional Trading of Enhabit

A number of hedge funds have recently made changes to their positions in EHAB. Metropolitan Life Insurance Co NY bought a new position in Enhabit during the second quarter worth $32,000. Quarry LP bought a new position in Enhabit during the first quarter worth $38,000. Gladius Capital Management LP bought a new position in Enhabit during the fourth quarter worth $42,000. Ameritas Investment Partners Inc. bought a new position in Enhabit during the second quarter worth $48,000. Finally, FMR LLC lifted its stake in Enhabit by 104.9% during the first quarter. FMR LLC now owns 4,642 shares of the company’s stock worth $65,000 after purchasing an additional 2,377 shares during the last quarter.

Enhabit Company Profile

Enhabit, Inc provides home health and hospice services in the United States. Its home health services include patient education, pain management, wound care and dressing changes, cardiac rehabilitation, infusion therapy, pharmaceutical administration, and skilled observation and assessment services; practices to treat chronic diseases and conditions, including diabetes, hypertension, arthritis, Alzheimer’s disease, low vision, spinal stenosis, Parkinson’s disease, osteoporosis, complex wound care and chronic pain, along with disease-specific plans for patients with diabetes, congestive heart failure, post-orthopedic surgery, or injury and respiratory diseases; and physical, occupational and speech therapists provide therapy services.

Read More

Before you consider Enhabit, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Enhabit wasn’t on the list.

While Enhabit currently has a “Reduce” rating among analysts, top-rated analysts believe these five stocks are better buys.

If a company’s CEO, COO, and CFO were all selling shares of their stock, would you want to know?