Zacks Research Brokers Lower Earnings Estimates for Zoetis Inc. (NYSE:ZTS)

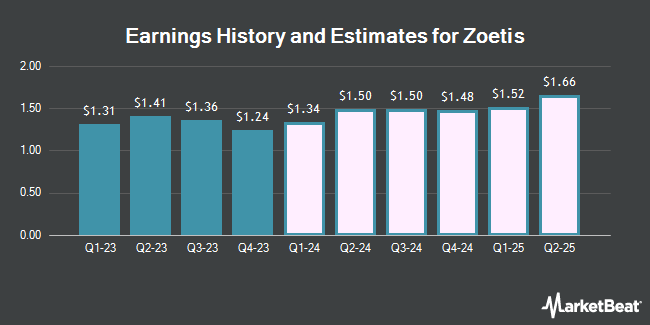

Zoetis Inc. (NYSE:ZTS – Free Report) – Zacks Research lowered their Q2 2024 earnings per share (EPS) estimates for shares of Zoetis in a research report issued on Tuesday, March 5th. Zacks Research analyst E. Bagri now anticipates that the company will post earnings per share of $1.50 for the quarter, down from their previous forecast of $1.53. The consensus estimate for Zoetis’ current full-year earnings is $5.79 per share. Zacks Research also issued estimates for Zoetis’ FY2024 earnings at $5.81 EPS, Q2 2025 earnings at $1.63 EPS and FY2025 earnings at $6.44 EPS.

Zoetis (NYSE:ZTS – Get Free Report) last released its quarterly earnings data on Tuesday, February 13th. The company reported $1.24 earnings per share for the quarter, missing the consensus estimate of $1.32 by ($0.08). Zoetis had a net margin of 27.43% and a return on equity of 51.25%. The firm had revenue of $2.21 billion during the quarter, compared to analysts’ expectations of $2.19 billion. During the same period in the previous year, the business earned $1.15 earnings per share. The business’s revenue for the quarter was up 8.5% on a year-over-year basis.

A number of other brokerages have also recently commented on ZTS. Piper Sandler increased their target price on Zoetis from $215.00 to $220.00 and gave the company an “overweight” rating in a report on Tuesday, February 20th. BNP Paribas began coverage on Zoetis in a report on Thursday, December 7th. They set an “outperform” rating and a $237.00 target price on the stock. The Goldman Sachs Group increased their target price on Zoetis from $190.00 to $226.00 and gave the company a “buy” rating in a report on Wednesday, January 17th. Jefferies Financial Group reiterated a “buy” rating and set a $230.00 target price on shares of Zoetis in a report on Tuesday, December 19th. Finally, StockNews.com cut Zoetis from a “strong-buy” rating to a “buy” rating in a report on Tuesday, February 20th. Nine equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, Zoetis has a consensus rating of “Buy” and an average target price of $224.33.

View Our Latest Stock Analysis on ZTS

Zoetis Stock Performance

NYSE ZTS opened at $182.16 on Friday. The business has a 50 day moving average price of $191.99 and a 200 day moving average price of $183.67. The company has a market capitalization of $83.41 billion, a P/E ratio of 35.93, a PEG ratio of 2.80 and a beta of 0.87. The company has a debt-to-equity ratio of 1.32, a current ratio of 3.36 and a quick ratio of 2.00. Zoetis has a 1-year low of $151.03 and a 1-year high of $201.92.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in ZTS. Fairfield Bush & CO. acquired a new position in Zoetis in the first quarter valued at $134,000. Sequoia Financial Advisors LLC raised its position in Zoetis by 5.3% in the first quarter. Sequoia Financial Advisors LLC now owns 4,166 shares of the company’s stock valued at $786,000 after purchasing an additional 211 shares during the period. Candriam Luxembourg S.C.A. raised its position in Zoetis by 3.9% in the first quarter. Candriam Luxembourg S.C.A. now owns 51,581 shares of the company’s stock valued at $9,727,000 after purchasing an additional 1,914 shares during the period. Covestor Ltd raised its position in Zoetis by 102.8% in the first quarter. Covestor Ltd now owns 724 shares of the company’s stock valued at $137,000 after purchasing an additional 367 shares during the period. Finally, Merit Financial Group LLC raised its position in Zoetis by 92.8% in the first quarter. Merit Financial Group LLC now owns 2,342 shares of the company’s stock valued at $442,000 after purchasing an additional 1,127 shares during the period. Institutional investors and hedge funds own 89.47% of the company’s stock.

Insider Transactions at Zoetis

In other news, EVP Roxanne Lagano sold 2,500 shares of the firm’s stock in a transaction on Thursday, December 14th. The stock was sold at an average price of $200.00, for a total transaction of $500,000.00. Following the sale, the executive vice president now owns 19,415 shares in the company, valued at $3,883,000. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders have sold 3,786 shares of company stock worth $748,470 over the last quarter. 0.12% of the stock is currently owned by insiders.

Zoetis Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, June 4th. Stockholders of record on Friday, April 19th will be issued a dividend of $0.432 per share. This represents a $1.73 annualized dividend and a dividend yield of 0.95%. The ex-dividend date of this dividend is Thursday, April 18th. Zoetis’s dividend payout ratio (DPR) is 34.12%.

Zoetis Company Profile

Zoetis Inc engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, and diagnostic products and services in the United States and internationally. The company commercializes products primarily across species, including livestock, such as cattle, swine, poultry, fish, and sheep and others; and companion animals comprising dogs, cats, and horses.

Featured Articles

Receive News & Ratings for Zoetis Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Zoetis and related companies with MarketBeat.com’s FREE daily email newsletter.